Could you get convicted of money laundering buying money orders?

Is it safe to buy money orders?

Cindy Omidi, mom to two brothers who owned 1-800-GET-THIN, was convicted of violating a federal law that prevents buying money orders under the reportable amount to avoid reporting. Omidi faces up to 10 years in a federal prison.

Omidi allegedly bought more than 300 money orders of $2,900 each over an extended period of time. The money orders were paid for with cash and then deposited into a business bank account.

It’s legal to buy money orders. But what Omidi did wrong was attempt to circumvent the rules. By breaking up the money order amounts to just below the reporting level, engaged in structuring or smurfing.

Structuring or smurfing

Structuring or smurfing refers to keeping financial transactions below reportable amounts.

If convicted of structuring you could go to jail for up to 5 years and/or pay a fine of up to $250,000.

The penalty is doubled if you structured more than $100,000 over a twelve month period or also broke another law.

Bank Secrecy Act of 1970 (BSA)

Under the Bank Secrecy Act of 1970 (BSA), banks, financial institutions, and other places that deal with cash instruments have to report transactions that exceed certain amounts.

The BSA states that banks must:

- Establish effective BSA compliance programs

- Establish effective customer due diligence systems and monitoring programs

- Screen against Office of Foreign Assets Control (OFAC) and other government lists

- Establish an effective suspicious activity monitoring and reporting process

- Develop risk-based anti-money laundering programs

Amounts that have to be reported

Here is a list of what must be reported:

- Same day cash transactions of $10,000 or more

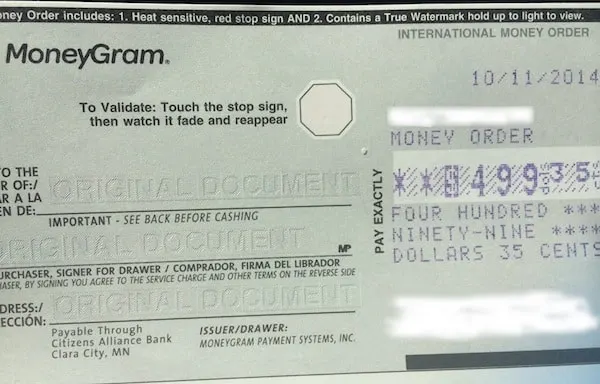

- Money order purchases of $3,000 to $10,000

- Any suspicious criminal activity (money laundering, tax evasion, etc.)

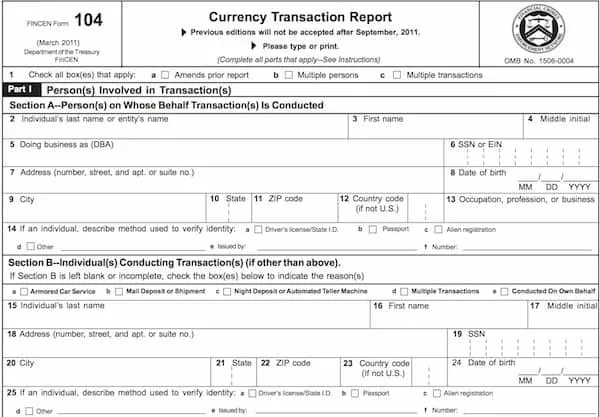

Deposits of $10,000 or more are reported on a Currency Transaction Report (CTR)

A Currency Transaction Report (CTR) is completed for $10,000 or more same day cash transactions. The CTR is filed with the Internal Revenue Service (IRS).

Anyone buying money orders of $3,000 to $10,000 is listed on the Monetary Instrument Log (MIL) form. The MIL is kept on file for five years.

If you’re suspected of trying to avoid reporting, a Suspicious Activity Report (SAR) is filed with the Financial Crimes Enforcement Network with the US Treasury Department.

Pro-tip: As of September 21, 2023, a bank employee can also fill out a SAR for transactions of $5,000 or more if they suspect money laundering or any other violations of the Bank Secrecy Act.

Buying money orders with gift cards

If you’re buying money orders with gift cards bought with a miles and points earning or cash back credit card, you shouldn’t be too concerned. Unless you’re participating in fraud and trying to scam someone.

Because you’re manufacturing airline miles and points, not hiding cash by money laundering, you probably won’t be accused of money laundering. Buying money orders is the new US Mint coins, and no one who bought US Mint coins was accused of money laundering.

But it’s a good idea, if you’re not already, to keep all your receipts.

Are you worried that buying money orders could be considered money laundering?

Disclosure: I am not a lawyer. These opinions are my own based on my interpretation of the rules and laws.

Comment, tweet, or share this post.

Get the best credit card signup bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Richard

Wednesday 6th of September 2017

can i get charge for money laundering if I'm buying money orders to pay my bills with money order. i usually have 10k in bills and i go to a few places to get money order to pay rent, credit card bills, car payments, and etc bills

Bank Cash Deposits - FlyerTalk Forums

Tuesday 24th of March 2015

[…] or more a day and the bank has to file paperwork - https://www.travelingwellforless.com/...ey-laundering/ __________________ Get more from your travel dollar: Travel, miles & points […]

Kris

Monday 13th of October 2014

Good info. What do you mean by "use Kate" at Walmart, Debbie? Thanks!

Debbie @ Traveling Well For Less

Monday 13th of October 2014

Hi Kris,

Thanks. Kate at WM is the kiosk aka Walmart Money Center Express machine.

Chris

Monday 13th of October 2014

Hi, I'm assuming gift cards work for buying money orders? I live in south Jersey, can find a place to buy money orders with a gift card to save my life, tried post offices, walmarts, grocery stores and all declined. This is with a meta bank gift card. I just need to find 1 lousy place that takes them.

Debbie @ Traveling Well For Less

Monday 13th of October 2014

Hi Chris,

Yes, you can buy money orders with gift cards. But some areas have different restrictions. Meta Bank runs through as a credit that's why their being declined. At WM, use Kate and hit the change payment button.

Have you tried OV? It works well at grocery stores, at least in my area.