With Plastiq, you can pay your rent with a credit card. You can pay your mortgage with a credit card. You can pay your car payment or auto loan with a credit card. You can also use a debit card.

This is an easy way to earn lots of miles, points, and cashback.

When you use a travel rewards credit card or a cash back card on Plastiq, you’ll earn travel rewards like airline miles, hotel points, credit card points, and cash back. Here’s how.

What is Plastiq

Plastiq is a payment service that lets you use a credit card or debit card to pay bills that you normally can’t pay using a credit card or debit card.

You can use Plastiq to pay rent, your mortgage, utilities, insurance, and other bills that you normally can’t pay with a credit card or debit card.

Pro-tip: The best part about using Plastiq to pay your bills, charges are considered a purchase and not a cash advance. So you’ll earn frequent flyer miles, cashback, and credit card points.

Plastiq Fees

You can create a free Plastiq account. But you’ll pay a fee if you use your credit or debit card for bill payment.

The Plastiq fee for paying bills with a credit card is 2.9% (was 2.85% prior to Dec 1, 2022). If you use a debit card, the fee is 1%.

You can make a one-time payment or a recurring payment. Payments can be made by paper check, ACH (Automated Clearing House) Bank Transfer, or wire transfer.

Pro-tip: When you send payment via a check, the check is written in your name.

The company receiving the money doesn’t need a Plastiq account to accept the payment unlike other online payment methods such as PayPal, Venmo, and Zelle. So your landlord doesn’t have to use or create an account with Plastiq to get your rent check.

What Cards Can You Use With Plastiq

You can use the following types of cards to send payments through Plastiq:

- Visa

- Mastercard

- American Express

- Discover

- Diners Club

Pro-tip: You can also use prepaid cards like Visa gift cards and Mastercard gift cards with Plastiq. So if you bought any gift cards at an office supply store when the fee for purchasing the cards is waived, you can use them on Plastiq to pay your bills.

Plastiq Restrictions

You can use Plastiq for a variety of bills that normally you can’t use a credit card to pay. But there are some restrictions.

You can’t use Plastiq to pay your credit card bill with a credit card. Nor can you use Plastiq to send a check to yourself or another private individual.

Some cards can’t be used for certain types of bill payments.

For example, you can’t pay your mortgage with a Visa credit card or an American Express credit card. But you can use a Mastercard credit card to make a mortgage payment on Plastiq.

Pro-tip: This credit card usage guide lists the types of payments that you can use for Plastiq by card type.

Who Should Use Plastiq

There are three times when you should use Plastiq to pay your bills: meet minimum spending to earn a big bonus on a travel rewards card, use a credit card to pay bills that don’t accept payment by credit card, give you more time to pay bills.

Meet Minimum Spending

Using Plastiq is an easy way to help you meet your minimum spending to earn a big credit card bonus on a travel rewards card.

You can earn 60,000 points after spending $4,000 on purchases in the first 3 months on the Chase Sapphire Reserve® Card. This equals $900 worth of travel when booking through the Chase Ultimate Rewards Travel Portal.

Pro-tip: You can get even more value when you transfer those points to travel partners.

The Chase Sapphire Preferred® Card is offering 60,000 points after spending $4,000 on purchases in the first 3 months. Those points are worth $750 in travel when booked through Chase Ultimate Rewards.

Currently, the Ink Business Preferred® Credit Card offers 100,000 points when you spend $8,000 in purchases in the first 3 months. This equals $1,000 cash back or $1,250 toward travel redeemed through the Chase Ultimate Rewards(R) portal.

The Platinum Card® from American Express currently offers an 80,000 point welcome bonus after spending $8,000 on purchases in the first 6 months. Terms apply.

The Business Platinum Card® from American Express is currently offering a 120,000 point welcome bonus after spending $15,000 on purchases in the first 3 months. Terms apply.

You can use Plastiq to make your minimum spending on your Chase Sapphire Reserve® Card, Chase Sapphire Preferred® Card, Ink Business Preferred® Credit Card, The Platinum Card® from American Express, or The Business Platinum Card® from American Express by paying your rent.

Using your Sapphire Prefered or Sapphire Reserve to pay rent or other bills on Plastic will cost $116 in fees.

You can transfer those 60,000 to 80,000 points to Hyatt and get your 9 nights at the Alila Ubud in Bali, 6 nights in Hawaii, or 17 nights in London. All of which cost much more than what you’d pay in fees.

Those 100,000 Chase Ultimate Rewards points from the Ink Preferred are worth $1,000 in cash back. Even paying the $427.50 in fees for the $15,000 in spending, you’d come out $572.50 ahead.

You’d pay $174 in Plastiq fees using your American Express Platinum card to spend $6,000 and spending $15,000 on your Platinum Business card will cost $435 in fees.

Because of the fee, some folks in the travel hacking community only use Plastiq to meet minimum spending when they have no other ways to do so.

Even with the fee, using Plastiq is worth it to me.

I use Plastiq to pay my mortgage every month. I don’t mind paying the fee because it saves me at least that in my time (the cost of having checks printed, writing a check, putting the stamp on it, and taking it to the post office).

Plus I earning several thousands of miles and points every month with no effort. And I don’t have to apply for new credit cards. An important consideration if you are at 5/24 and can’t or don’t want to apply for new cards.

But you have to do the math and see if it works out for you.

Pay Bills With A Credit Card

You can use Plastiq to pay bills with your credit card or debit card for bills that normally don’t accept payment by credit or debit card. Bills like your rent, mortgage, car payment, insurance, homeowners association fees, day care, school tuition, and more!

Pro-tip: Want to get started in real estate investing? You can use Plastiq for your down payment on a house.

More Time to Pay Bills

Using Plastiq gives you more time to pay bills. If cash is tight or you need a little breathing room, you can pay your rent with Plastic.

Paying your auto loan with Plastic can give you some extra time until you get paid. This could be a cheaper option than getting a payday loan.

Plastiq Referral Program

You can avoid fees on Plastiq with the Plastiq Referral Program. The referral program lets you earn credits (Fee-Free Dollars) that lower or eliminate fees.

A Fee-Free Dollar (FFD) equals 1 dollar sent without fees. If you applied 100 FFDs to a $300 auto loan, the fee is only applied to $200. So instead of paying $8.70 in fees, you’d only pay $5.80.

You earn 2,500 Fee-Free dollars per referral through the Plastiq referral program. And the person you refer also gets 1,000 Fee-Free Dollars.

If you want to earn 1,000 Fee Free Dollars, use my referral code to join Plastiq – http://plastiq.com/invite/1130227

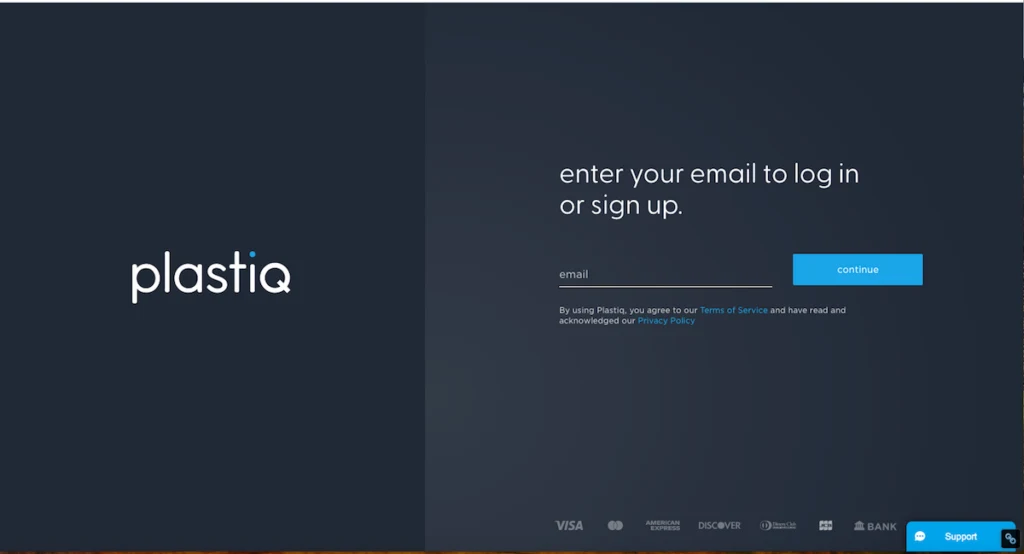

Create a Plastiq Account

You can easily create a free Plastiq account. From the Plastiq.com website, click the signup button in the upper right corner.

Enter your email address and click the blue continue button.

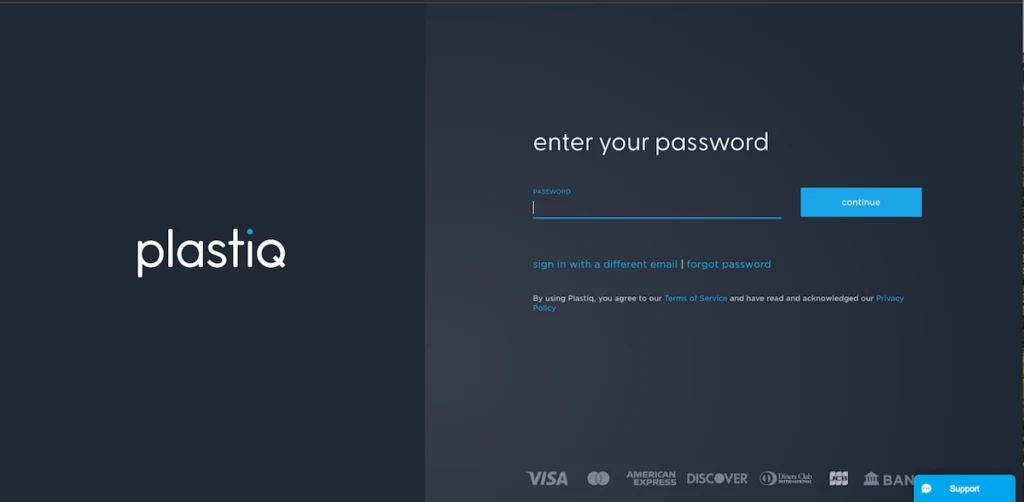

Create a password and click the blue continue button.

Verify your email address. Once verified, you can finish setting up your account.

You can only have one Plastiq account. You can’t use a different email address for a separate account.

Paying Bills With Plastiq

Paying bills with Plastiq is easy.

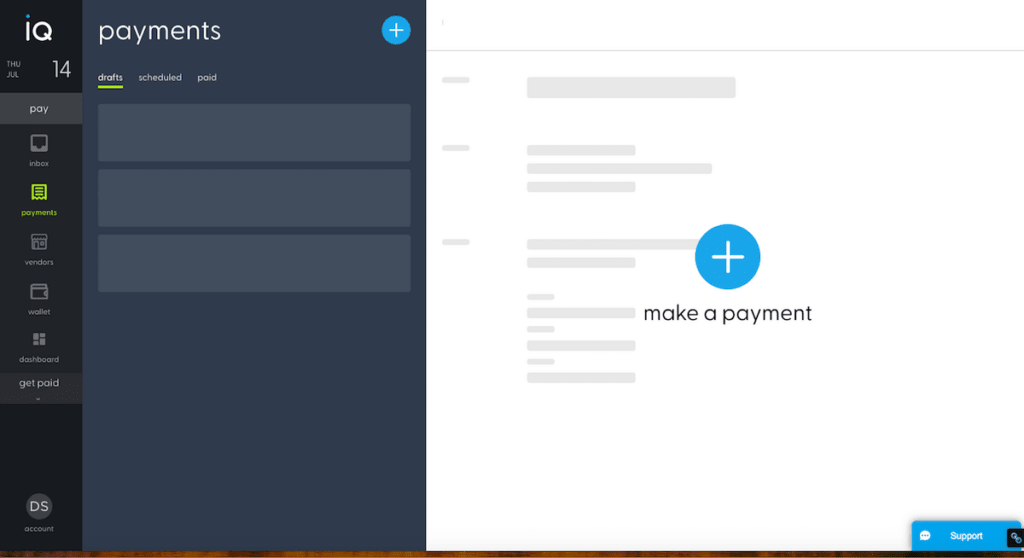

To make a payment, click the big blue plus sign on the right side of the payments screen. You can also click the small blue plus sign in the top middle of the screen.

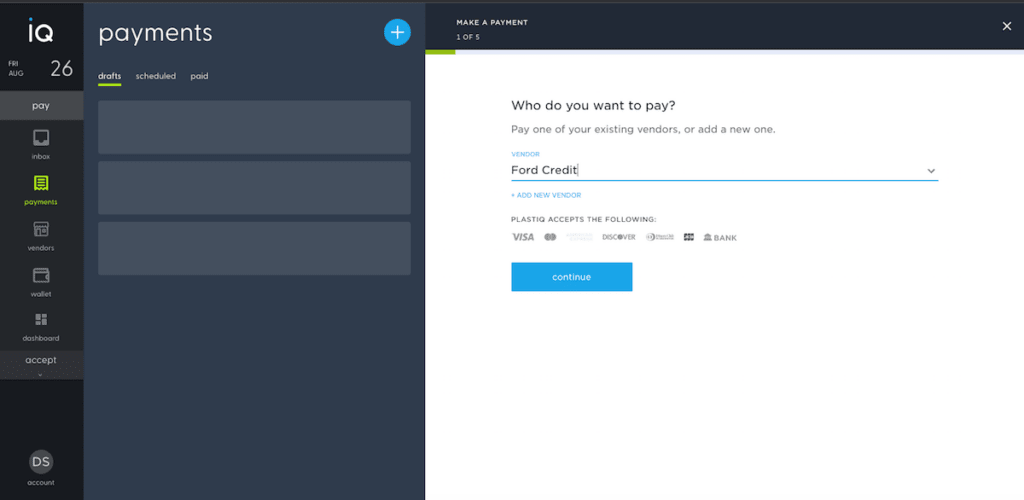

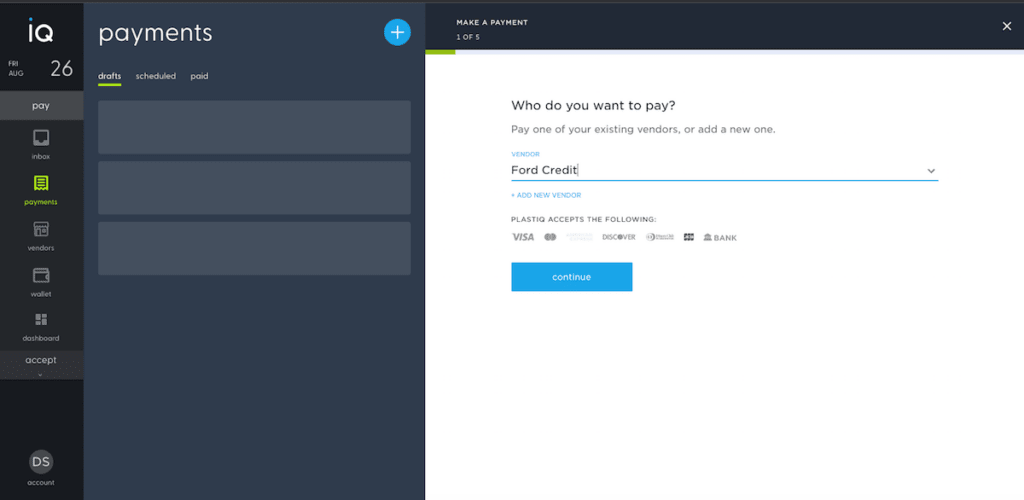

Type the name of the vendor you want to pay. Then click the + Create New Vendor. Click the blue continue button.

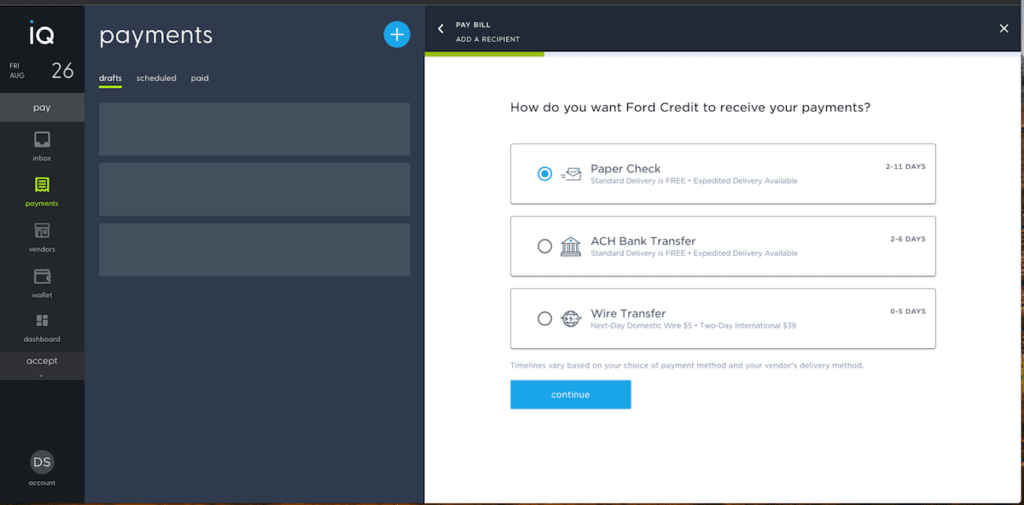

Choose your payment method: ACH Bank Transfer, wire transfer, or check. Plastiq automatically defaults to ACH. If you want to send payment another way, you have to click Paper Check or Wire Transfer.

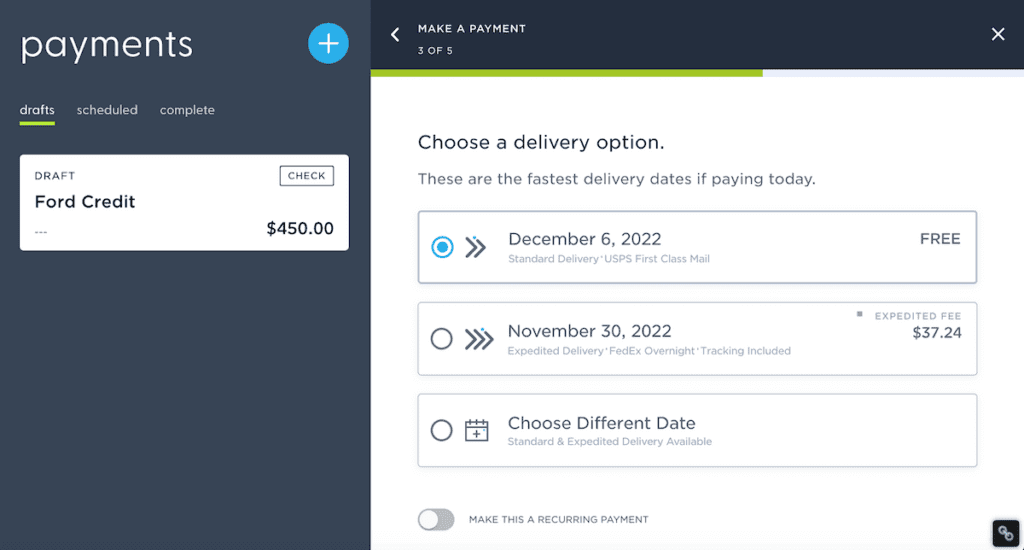

Pro-tip: You can send paper checks by regular mail for free. Checks can take up to 11 days to arrive. In my experience, it has taken about 8 days. So you’ll want to schedule your payment to allow for extra time.

If you forgot to schedule your payment in advance, you can pay for expedited delivery.

ACH payments are free and take up to 6 days to get to the vendor. Sometimes, they process as quickly as 1 business day. You can pay for expedited delivery if you need to send the money faster.

Wire transfers take up to 5 days to receive payment. You’ll pay $5 for next day delivery via wire transfer and $39 for two day international wire transfers.

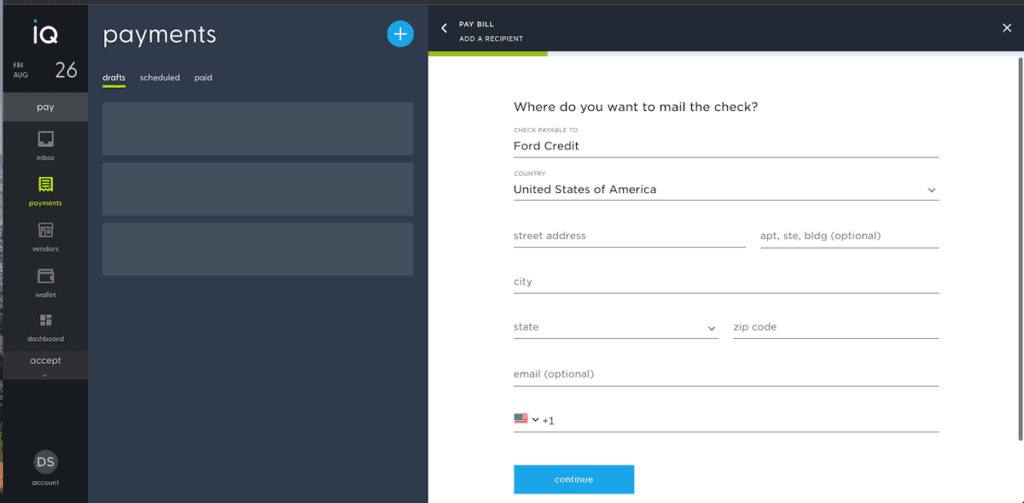

If you selected payment by check, add the address where you want the check mailed and a phone number. Then click the blue continue button.

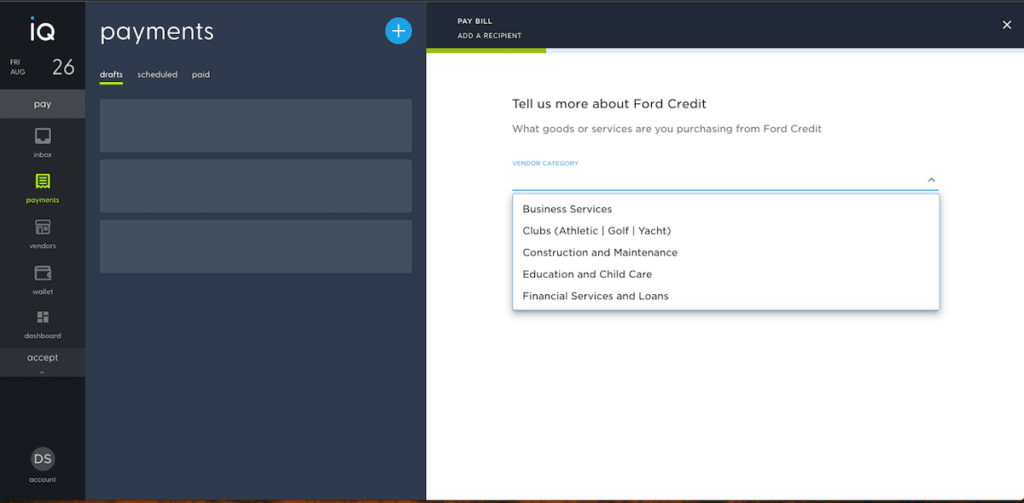

Choose the vendor category and vendor subcategory then click the blue create button.

Add the name of the vendor you want to pay and other details.

Choose who you want to pay and click the blue continue button.

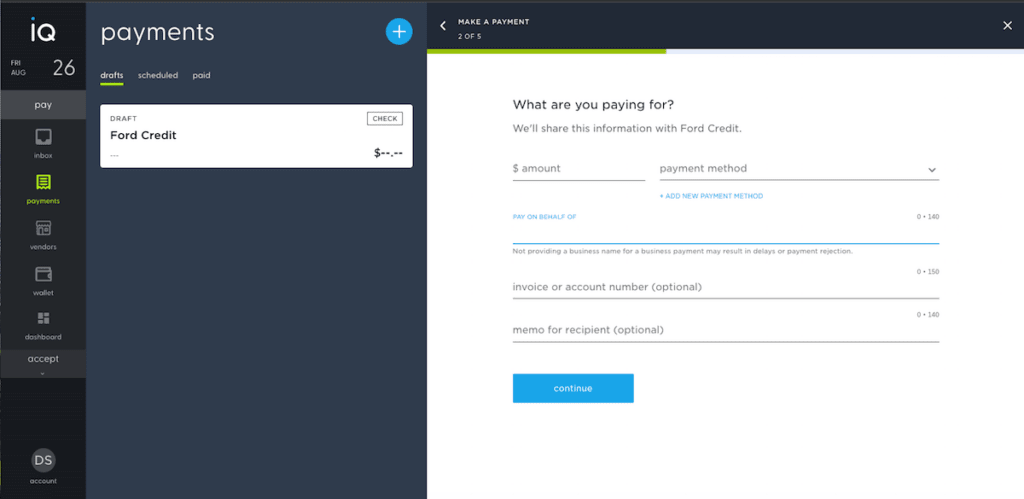

Enter the payment amount.

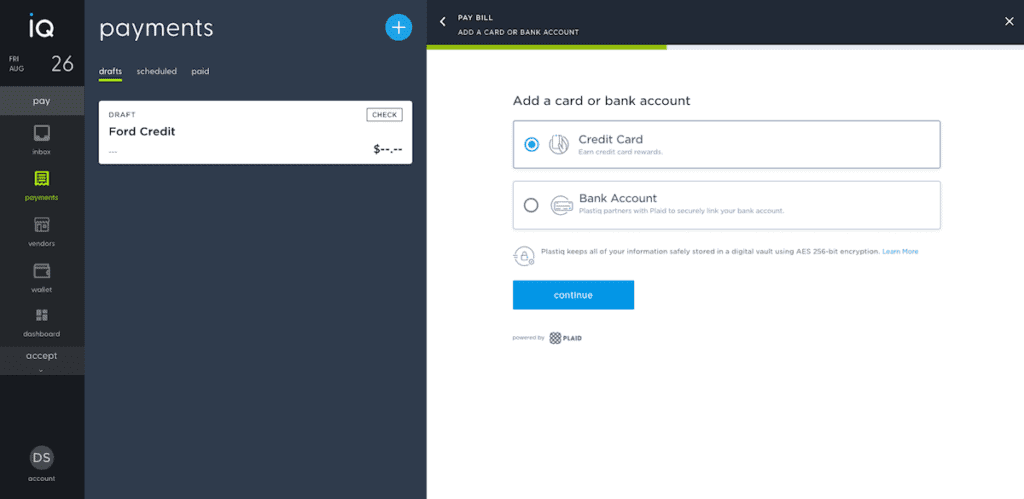

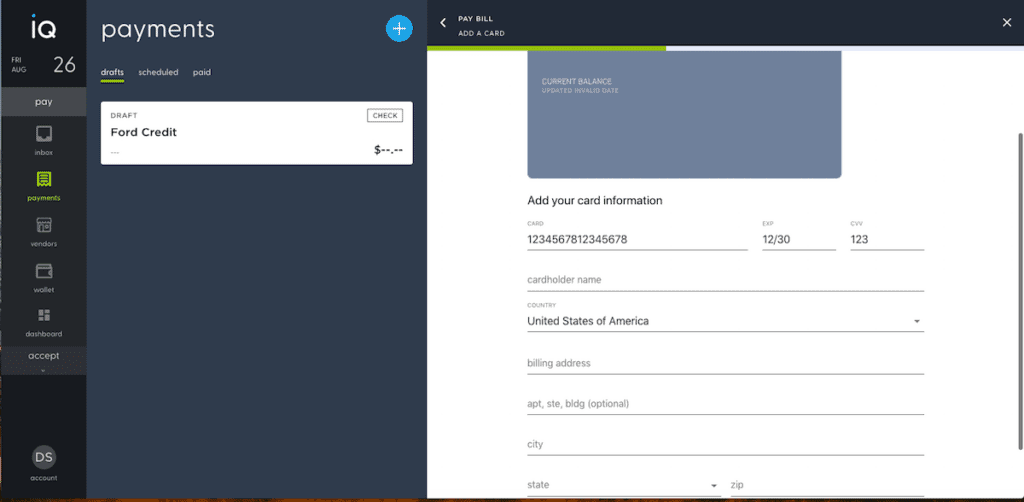

You can add your credit or debit card information by clicking the New Payment Method. You can add an unlimited number of credit cards to your account. Click the blue continue button.

Enter your credit card information and click the blue continue button.

Add who the check is being paid for, the invoice or account number, and a memo. When done, click the blue continue button.

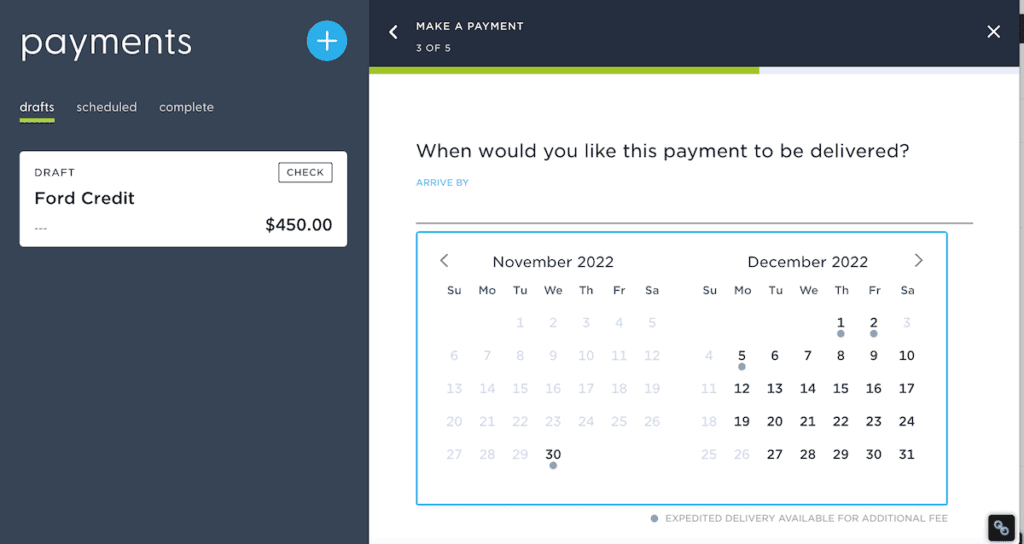

Click the date you want your payment delivered.

If you want your payment sent on a different date. Click on Choose Different Date and select from a calendar view.

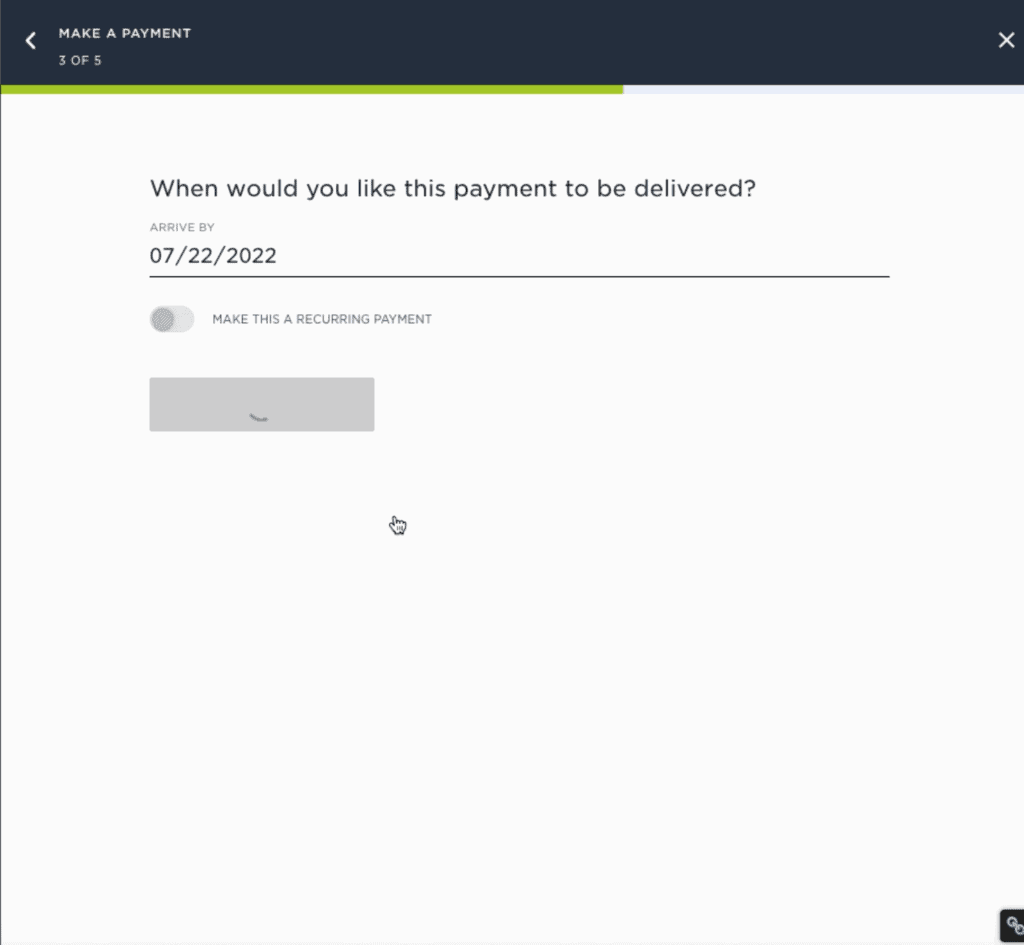

Double-check the date. You can set this up as a recurring payment on the same date by toggling the button to Make This a Recurring Payment. Click the blue continue button.

You can upload an invoice or other documentation. After uploading, click the blue continue button.

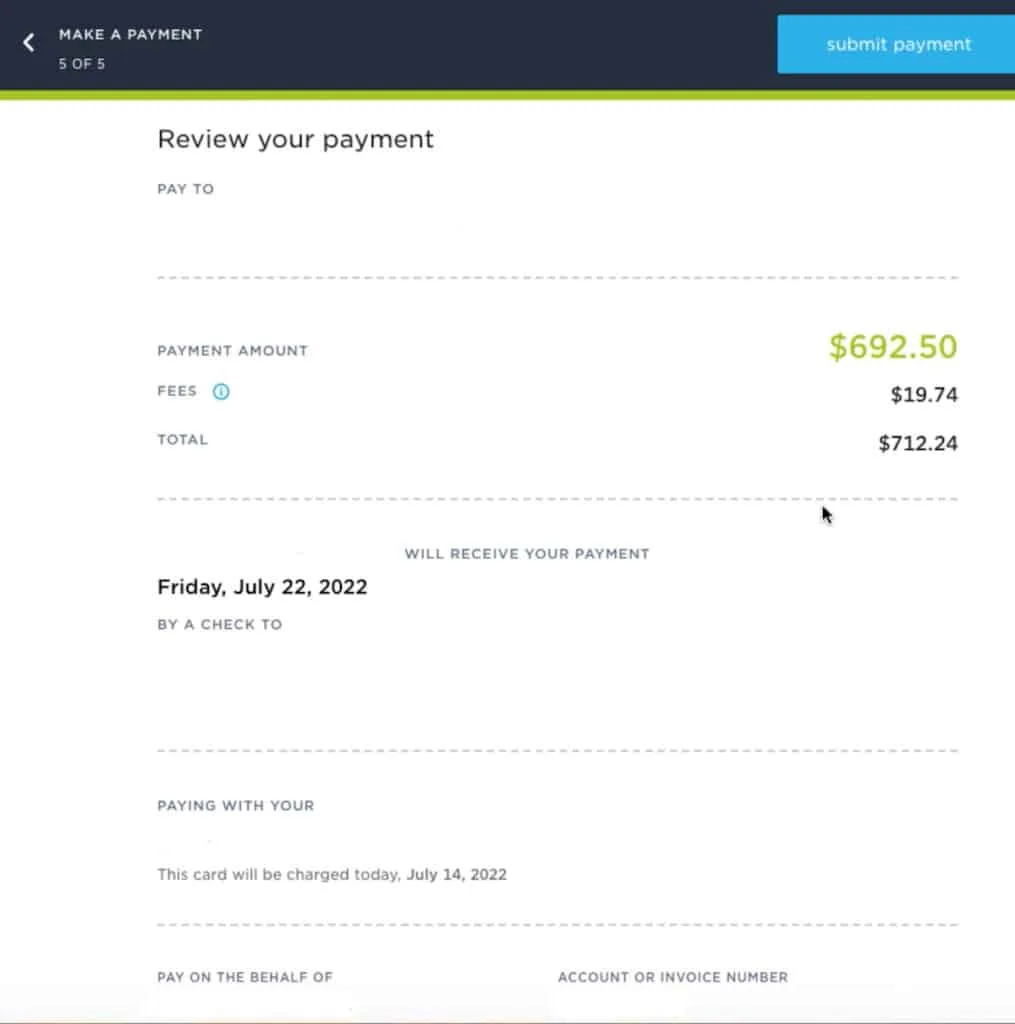

Review your information to make sure everything is correct.

You’ll see a breakdown of your payment and fees on the payment review screen.

Pro-tip: You also earn cash back, frequent flyer miles, credit card, and hotel points on the Plastiq fee.

If everything is correct, click the blue submit button (at the bottom of the screen and top right corner of the screen).

The person you’re paying won’t get paid until the scheduled date, but your credit card is charged immediately after you click submit payment.

The next screen shows that your payment was submitted and gives you a payment ID number.

Click the black make another payment button to process another payment. Or log out by clicking your initials in the lower left corner of the screen and choosing logout.

Payment Guarantee

Plastiq offers a payment guarantee. If your payment is not delivered by the quoted date, they will reimburse any late fees.

This doesn’t mean that if your payment was due on the 1st, but you waited until the 1st to sign into Plastiq and send a check, they’ll reimburse late fees because it was received after the 1st.

It means if you scheduled your payment in advance, accounting for the delivery time, and your payment was late, if your car loan company, landlord, etc. charge a late fee, Plastiq will reimburse you the cost of the late fee.

So, if you signed into your account on the 26th to make a payment due on the 15th and your payment is received after the 15th, if you’re charged a late fee, you can get the amount of your late fee sent to you by Plastiq.

Because of the fee, some folks in the travel hacking community only use Plastiq to meet minimum spending when they have no other ways to do so.

After scheduling your payment, Plastiq will send you a confirmation email. You’ll receive a second email when your payment has been accepted by your vendor.

Who Shouldn’t Use Plastiq

Plastiq is a great option for many people, but there are some who shouldn’t use Plastiq. You should only use Plastiq if you can pay off your credit card bill in full each month.

Because the fees and interest charged for not paying off your balance, negates any airline miles, credit card, hotel points, and cash back earned.

Pro-tip: If you can’t pay your credit card balance off each month, consider getting a 0% intro APR balance transfer card.

Watch the video on Plastiq.

Plastiq and Silicon Valley Bank

Plastiq temporarily suspended bill payments to US vendors and some other countries for a few days during the Silicon Valley Bank (SVB) collapse.

I reached out via email because I use Plastiq to pay several bills.

Hi Debra,

Thanks for reaching out to Plastiq Support.

Due to an ongoing issue with our banking partner, we are temporarily not accepting new payments to US vendors.

We hope to accept payments again within 1-2 business days. If your payment is urgent, we encourage you to make that payment via another means.

We will communicate to our customers as we have more clarity on the status of SVB and our own efforts to add additional processing capabilities.

We apologize for the inconvenience.

They quickly found another bank to handle payment processing.

Plastiq Bankruptcy

Plastiq filed for Chapter 11 bankruptcy. If you use Plastiq to pay your bills, as I do, you’re probably wondering if your payments will be paid.

I emailed because I have a pending payment and wanted to see if I needed to make other arrangements, here’s their response.

Hi Debra,

Payment ID# [number] was sent and will arrive on [date] without issue.

Plastiq has been in discussion with potential acquirers for several months. As part of the acquisition process the company has voluntarily filed for Chapter 11 bankruptcy protection, to reorganize its business for the benefit of our customers. This will serve as a catalyst for us to be an even better partner to you, throughout the restructuring process and into the future.

Your expectations should be business as usual and that your money and transactions are secure. We have already secured all necessary financing for operations and have received a “stalking-horse” acquisition proposal from Priority Technology Holdings.

Priority is the 4th largest non-bank payments business in the US. Priority serves over 800 thousand customers, processing $110 billion in annual payments volume across its SMB, B2B, and Enterprise payments operating divisions. We have already integrated our payments operations activities with Priority to ensure the stability of your transaction processing and to continue to provide the exceptional level of service you have come to expect from Plastiq.

Our goal in filing for Chapter 11 is to emerge as a stronger and more profitable company that can better serve customers going forward. It should allow us to streamline our operations in partnership with Priority and improve our financial foundation, positioning Plastiq for sustainable long-term growth. As noted above, we believe our partnership with Priority should already assure our customers of stable operations going forward. You can read more about Priority below.

Chapter 11 restructuring is a legal process that allows companies to reorganize their debts and liabilities while continuing to operate their business.

We are committed to open and transparent communication throughout this process, and appreciate your support to our ongoing partnership by continuing to do your business with us as you have before. Should you have further questions, please feel free to email us.

Thank you for your loyalty, we appreciate your continued patronage and support.

Long story short, unlike the temporary halt of payments when Silicon Valley Bank closed, your bills with get paid and paid on time. If anything changes, I’ll let you know.

Conclusion

You can pay rent, mortgage, car payments, and other bills with your credit card and debit card with Plastic.

It’s free to create an account but you’ll pay a fee of 2.9% to use your credit card to pay bills and 1% if you pay with a debit card.

Plastiq is a great way to meet minimum spending on a big credit card bonus. It also gives you more time to pay bills and can be cheaper than getting a payday loan.

But the service isn’t for everyone. If you can’t pay your bills in full, you shouldn’t use Plastiq.

Have you used Plastiq?

Comment, tweet, or share this post.

Get the best credit card bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Support us on Patreon | Buy Me a Coffee

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Marysa

Saturday 10th of December 2022

It is good to have this option, especially if you are able to get some reward points or manage money better.

Rosey

Thursday 8th of December 2022

Plastiq is new to me. I'm glad to hear about it here. Sounds like it could be so very helpful.

Catalina

Thursday 8th of December 2022

wow! It is useful to know how I can earn when paying my rent. Thanks a lot!

Melissa Cushing

Thursday 8th of December 2022

Credit cards are great for when in a pinch but the days more and more people are using them for necessities because of crazy high prices. You have to do what you have to do. Thank you for this informative post!

Renee

Thursday 8th of December 2022

I always heard it was a bad idea to pay your bills with a credit card. I can see this being useful if one has to though.