I just got an email from Chase offering up to 40,000 miles sign-up bonus for the United℠ Explorer Card with a waived annual fee for the first year. Did you get one too?

Update: The credit card offer in this post is no longer available. This offer has ended. The new offer is 60,000 miles. Check our travel rewards card page for the latest offers.

You can earn 60,000 United Airlines miles from the United℠ Explorer Card after spending $3,000 on purchases in the first three months your account is open. The United℠ Business Card offer of 75,000 miles after spending $5,000 on purchases in the first 3 months is a public offer. Plus the first year annual fee on the business card is waived, then $99.

Because this is an airline-branded credit card and not one solely branded by Chase like the Chase Sapphire Preferred® Card, you can get the personal and business versions of this card again. As long as it’s been 24 months since you received the sign-up bonus.

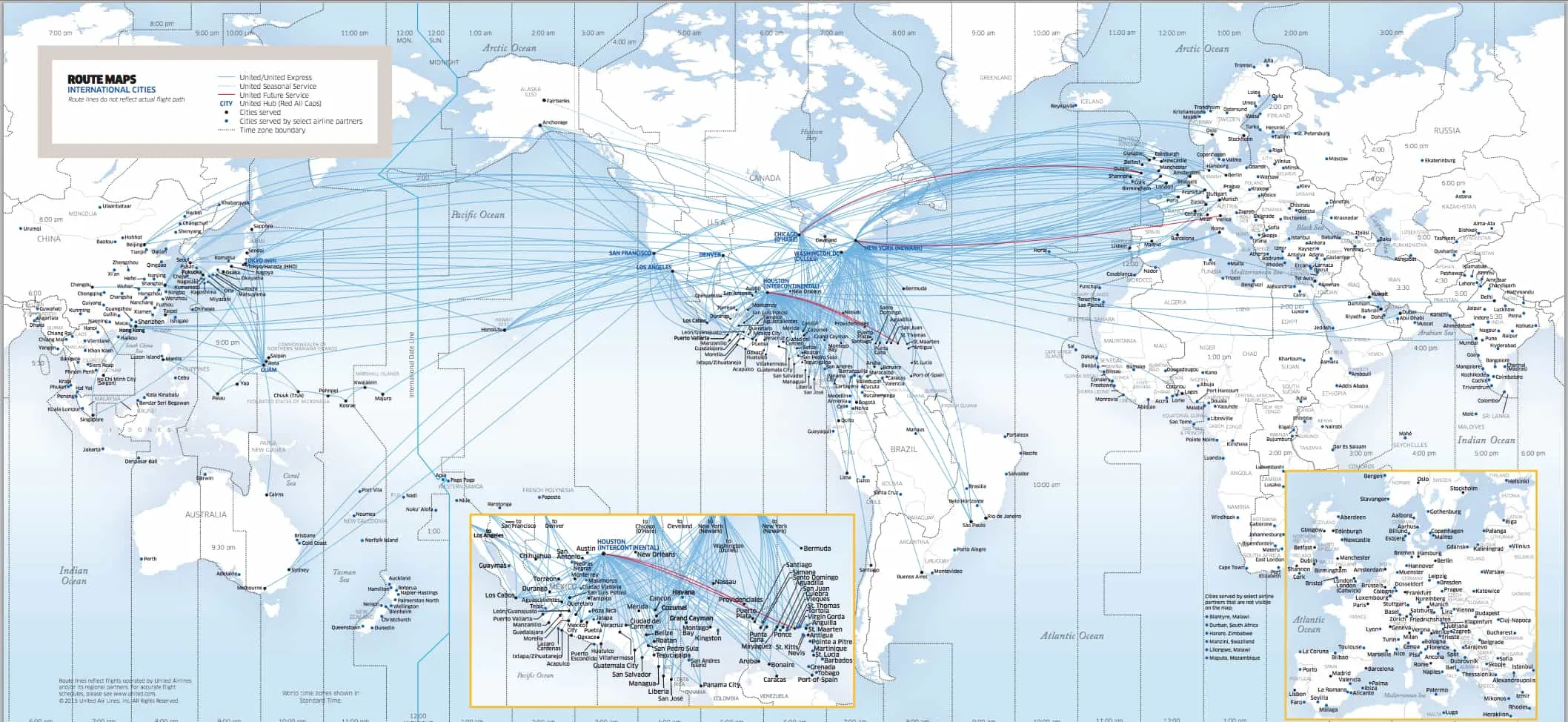

Where will your 60,000 United Airlines miles take you?

United℠ Explorer Card

Normally the sign-up bonus on these cards is 30,000 United Airlines miles. So if you were planning on getting the United℠ Explorer Card now’s a good time.

In addition to the $95 annual fee waived for the first year, you get:

- 60,000 after spending $3,000 on purchases in the first 3 months

- Free checked bag for you and one companion

- Priority boarding

- 2 United Club airport lounge passes each year

- No foreign transaction fees

- 2 United Airlines miles for every $1 spent on United Airlines

- 2 United Airlines miles for every $1 spent at restaurants, hotels (booked directly with the hotel)

- Up to $100 credit for Global Entry or TSA PreCheck

- 25% back on inflight purchases

- Member FDIC

2 Unpublished Benefits

There are a couple of additional perks to the United Explorer Card and United℠ Business Card that are not always mentioned.

1. Access to More Award Seats

When you have this card, you’ll be able to see more available award seats. This means you’ll have more options for using your United Airlines miles. So you could have better luck at getting multiple seats on the same flight.

2. Get or Keep Elite Status

You can get or keep elite status as a Chase United MileagePlus Explorer card holder. You can earn up to 1,000 PQPs from this card.

Unfortunately, the Premier Qualifying Dollar spending requirement is not waived for United 1K members. 🙁

Conclusion

Check your email to see if you were targeted for the personal offer. The business offer is a public offer.

With the Chase United MileagePlus Explorer card, you’ll have perks like access to more award seats, get a free checked bag for you and a travel companion, and priority boarding. All for no annual fee (at least for the first year).

You can get these cards again if it’s been 24 months since you received the sign-up bonus.

If you got the targeted offer, are you going to apply?

Did you like this post? Feel free to comment below, share this post, or give me a +1.

Want to get more travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? To receive post updates by email, please use the subscription box at the top right of the page.

You can also follow me on Twitter, like me on Facebook, or add me on Google+.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.