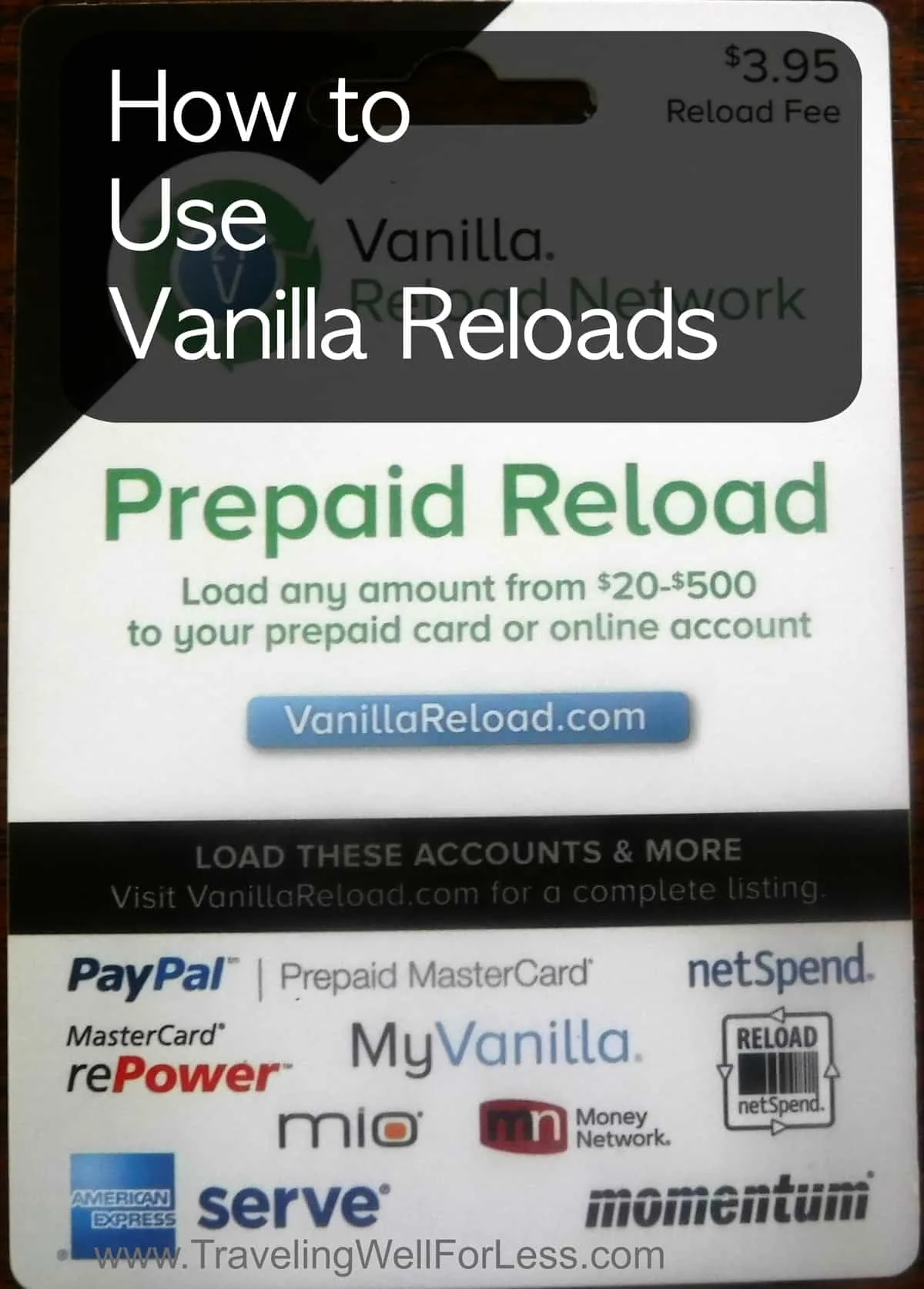

In a time long, long ago, the world was rife with Vanilla Reloads. You could find them on the corner, on every street.

In fact you could buy Vanilla Reloads “at the corner of happy and healthy.” Although not every store let you buy them with a credit card

But alas those days are long gone and Vanilla Reloads have gone the way of the Dodo bird. Or, more accurately in the miles and points game, gone the way of the Mint.

So I was surprised to meet someone who still had Vanilla Reloads. And he never loaded them to his Bluebird. He asked me what he can do with his Vanilla Reloads.

Here’s what I told him…

Sidenote: He knows I’m writing this post (he’s looking forward to reading it). However, because he didn’t specifically say I could use his name. So for the purpose of this post, I’m calling him Greg. (wink 🙂

6 Prepaid Cards Loadable With Vanilla Reload

Greg can no longer load his Bluebird with Vanilla Reloads nor can he load a Serve card (if he had one) so he needs someplace to offload those cards. There are six prepaid cards that can be funded with Vanilla Reloads.

1. My Vanilla Debit

You can buy My Vanilla Debit cards anywhere or order one online

One of the easiest prepaid cards to get is the My Vanilla Debit card. That’s because they are available everywhere (small fee) from grocery stores, drugstores, and stores like Target and free online.

Greg’s permanent card can be funded with up to $2,500 in Vanilla Reloads.

Buy Things or Pay Bills

He’ll pay a $0.50 fee to use his My Vanilla Debit card, both as a credit card or debit card. A small price to pay to be able to use those Vanilla Reloads that have been sitting in his sock drawer.

If Greg has a Citibank American Airlines Mastercard or Citi American Airlines Executive card, he can use his MVD to call in and make the bill.

Get Cash

Or he could withdraw money. Greg will pay a $1.95 fee to withdraw $400 a day from the ATM. Or a $1.95 fee to do a cash advance of up to $10,000 a day at the bank.

At the bank, Greg would inform the teller he’d like to do a cash advance, the amount, and hand them his card and driver’s license. Simple as that.

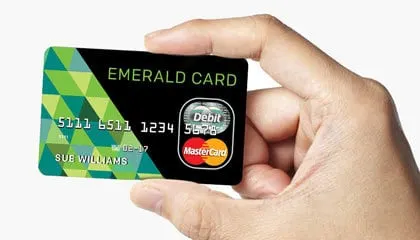

2. H&R Block Emerald

No fees to use the H&R Block Emerald card

Update: The H&R Block Emerald card is no longer open to new applicants.

Another prepaid card that can be loaded with Vanilla Reloads is the H&R Block Emerald card. Greg can order a free card online. Up to $9,999 per day can be loaded to the Emerald card.

Greg pays $0 fees to use this card for purchases (credit or debit). But there’s a $2.50 ($3 effective November 1, 2015) fee to withdraw up to $3,000 per day from the ATM.

And Greg can pay his Citibank American Airlines Mastercard or Citi American Airlines Executive card with the Emerald card.

But he should not use the H&R Block Emerald card for cash advances because there’s a $35 fee.

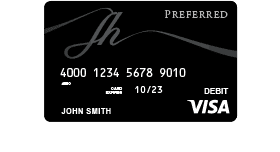

3. JH Preferred

Order a free JH Preferred card online

Like the H&R Block Emerald card, Greg can order the JH Preferred card online, make purchases without fees, and load up to $9,999 per day. He’ll pay $2.50 to get up to $2,550 from the ATM each day.

Greg can also use the JH Preferred card to pay his Citibank American Airlines Mastercard or Citi American Airlines Executive card bill.

Or for a $5.00 fee, he can get a cash advance at the bank.

4. NetSpend

Three choices of Netspend card plans, but fees may apply

Greg can order a NetSpend card online without fees and load up to $7,500 a day. Cha-Ching, Cha-Ching.

But depending on the plan he chooses, there may be fees to use the card. Greg would pay up to $2 to use the card for purchases.

Withdrawing cash from the ATM costs $2.50. And cash advances are not permitted.

The NetSpend card also has a free bill pay feature.

5. PayPal

You may not want to risk your PayPal account

Greg can order the PayPal prepaid MasterCard online for free or pay a temporary card for $4.95 at the drug store, grocery store, gas station, etc. PayPal charges a $4.95 monthly fee to use this card. There is a $2,500 daily load limit.

He’ll pay $1.95 to withdraw up to from the ATM each day. And this card can’t be used for cash advances. But Greg could transfer the money to his bank account.

However, he should be cautious because PayPal could close his card and shutdown his PayPal account.

6. Momentum

Add up to $7,500 a day on the Momentum card

Another possibility is the Momentum card because Greg can load up to $7,500 a day on this card (up to $10,000 a month). However, this card is limited to certain states, thankfully, California is one of them.

But it can only be purchased at a Money Mart or Loan Mart and the closest store is over 100 miles away. Plus there’s a $10 fee!

Greg should avoid this card like the plague because it’s fee ridden.

He can pay a monthly $10 fee to avoid per fee transactions on purchases. Or pay a $1 fee for each use including cash advances. Greg can get up to $1,000 in cash advances each day.

ATM fees are $2 per transaction and withdraw up to $1,000 a day.

Conclusion

Here’s how to use Vanilla Reloads if you (like Greg) have orphaned or unused Vanilla Reloads.

You can load your Vanilla Reloads to one of six different prepaid cards:

- My Vanilla Debit

- H&R Block Emerald

- JH Preferred

- NetSpend

- PayPal

- Momentum

Each card has different fees and limits, but the My Vanilla Debit card is Greg’s best choice.

Because it can be bought anywhere (fee) or ordered for free online. Greg can use his MVD to make purchases, make ATM withdrawals, or get cash from the bank.

Do you agree? If not, which card do you think Greg should get?

Comment, tweet, or share this post.

Get the best credit card bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

ken

Friday 11th of September 2015

Dont forget target prepaid card as yet another option.

Where are folks buying vanilla cards with cc's in texas these days? My last source dried up im April - Valero gas stations.

Debra Schroeder

Friday 11th of September 2015

Hi Ken,

If you're referring to the Target REDcard or Amex for Target card, you can not use Vanilla Reloads to load either card.

There are two types of Vanilla cards: Vanilla Reloads (photo in the blog post) which is used to load prepaid cards and Vanilla Visa which is a gift card. Here's my post which gift cards load to Target REDcard and Amex for Target - https://www.travelingwellforless.com/2015/05/07/loading-target-redcard-with-pin-enabled-gift-cards/.

Try HEB.