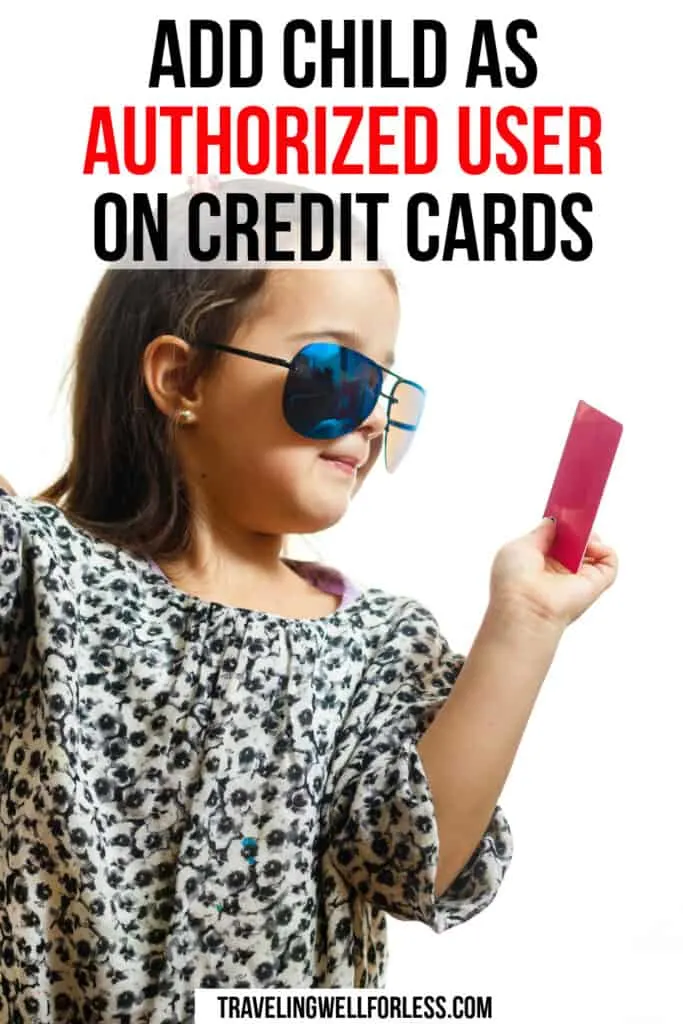

Did you know you can add your child as an authorized user on credit cards? But should you? Does adding a child as an authorized user on credit cards hurt you?

Here are the benefits of adding your children as authorized users to your cards and which banks let you add a child as an authorized user.

One of the best things you can do for your child is to teach them good financial habits. The earlier your children learn to manage their money and credit, the better.

Because once they go to college, join the military, or move out, they’re in control of their finances.

If your child has good credit, it’s easier to rent an apartment and get a higher paying job. They can also take out their own student loans to pay for college. 😉

You can give them a credit jumpstart and build their credit history when you add your child as an authorized user to your credit cards.

Adding a Child as an Authorized User on Credit Cards

As authorized users, your kids can build their credit score while helping you earn more miles and points

Here are some things you should know about adding children as authorized users on your credit cards.

What’s an Authorized User

An authorized user is someone who’s allowed to use your credit card but is not responsible to pay the bill.

So you want to be sure your kid won’t go crazy and run up your entire credit line after you’ve added them to your card.

Whereas, a joint user is responsible to pay the bill.

An authorized user isn’t legally responsible to pay the bill. They’re limited to making purchases only.

Usually authorized users can’t make changes to your card, such as requesting credit line increases, changing your address, or closing your card.

And usually, they can’t take out a cash advance or authorize a balance transfer.

How to Add An Authorized User

You can add an authorized user by calling the number on the back of your credit card. If you’re applying for a new credit card, you can add their name to the application.

When you add an authorized user to your card, the bank will issue a credit card with their name under your account.

Some banks like American Express will issue a new credit card number. While other banks like Chase, Citibank, Barclays, and US Bank will issue a card with the same credit card number.

Adding your child as an authorized user to credit cards is easy.

Why Add Your Child as an Authorized User

There are several reasons why you’d want to add your child to your credit cards.

1. Meet Minimum Spending Requirements

With teenage boys, you might see these types of charges on your credit card

Even with the 7 unusual ways to meet minimum spending requirements, sometimes it can be difficult to complete credit card minimum spending.

Adding your child or children to your credit cards can help you meet minimum spending requirements on newly opened credit cards with large sign-up bonuses.

Your child can be making purchases at the same time you’re making purchases, so you’ll reach your minimum spending sooner.

2. Exceed Daily Limits

Bypass limits on Simon Mall gift card purchases with authorized users

Adding your child as an authorized user on credit cards means you can vacation more.

Because some purchases, such as gift cards, are limited to a daily purchase amount, when you add your child or children as authorized users, you can exceed those daily purchase limits by double, triple, or quadruple.

For example, Simon Mall gift cards are limited to $10,000 a day per person. If your kids are authorized users on your credit cards, this means you can buy $40,000 worth of Simon Mall gift cards a day (or more depending on how many kids or authorized users you have).

So put those kids to work, it’s about time they helped earn miles and points for the family.

3. Bonus Miles and Points

5,000 miles or points can make a difference where you get to vacation: Newark or Kauai in the winter…

Some banks may offer bonus miles when you add an authorized user to your account.

4. Establish Credit

Authorized users can boost their credit score

Your child can establish credit.

Adding your child as an authorized user to credit cards will start their credit history.

They’ll get a huge leg up in terms of their credit score by being able to piggyback on your credit (assuming you have good credit).

A great credit score is the golden ticket and can help your child get a job, get into college, etc. Because you don’t want them to be living at home without a job!

Plus your kid may get targeted for large welcome offers/bonuses!

My kids get 100,000 offers from The Platinum Card® from American Express every few months.

Pro-tip: Yes, you can use someone else’s 100k Amex Platinum code!

5. Teach Budgeting

Safely keep authorized user cards out of spendthrift hands

Adding your children as authorized users on your credit card teaches them responsibility, budgeting, and prepares them for living on their own.

Although, some parents may feel more comfortable using prepaid cards or gift cards vs adding their kids to their credit cards.

But just because you add your kids as authorized users doesn’t mean you have to actually give them the cards.

What they don’t know won’t hurt them nor will it hurt your credit.

6. Airport Lounge Access

Authorized users of some cards like the Chase Sapphire Reserve® Card and the Delta SkyMiles® Reserve Business American Express Card get free airport lounge access.

Starting February 1, 2025, Reserve Card Members are limited to 15 Delta Sky Club Lounge visits per year. You have to spend $75,000 or more in eligible purchases on your card between January 1, 2024 and December 31, 2024 and each subsequent calendar year for unlimited visits. After the 15 free visits have been used, Business Reserve Card Members can purchase additional visits for $50 per person per visit.

Pro-tip: Most airport lounges have a minimum age requirement of 18. So your unaccompanied minor won’t be able to use their lounge benefit. But once they become an adult, they can relax in the lounge.

7. Global Entry and TSA PreCheck Refunds

Authorized users on The Platinum Card® from American Express and The Business Platinum Card® from American Express are eligible for Global Entry and TSA PreCheck refunds.

8. Statement Credits

Some cards allow authorized users to take advantage of perks like statement credits.

Which Banks Let You Add a Child as a Credit Card Authorized User

Banks have different rules on adding children as authorized users to credit cards. Some banks, like American Express, have restrictive rules. Whereas other banks, like Capital One, are very lenient.

1. American Express

Your child must be at least 13 years old to be added as an authorized user to your American Express cards. This is great news because when I first wrote this post, the minimum age used to be 15.

Have your child’s date of birth and social security number handy because it’s a requirement. American Express reports authorized user accounts to the credit bureaus.

Depending on when you opened your first Amex account and your child’s age, they might become a member many years before they were born. 😉

Do you know which American Express cards charge a fee for authorized user cards?

American Express does not charge a fee for authorized users cards on:

- American Express® Gold Card

- American Express® Business Gold Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Card

- Amex EveryDay® Preferred Credit Card

- Hilton Honors Surpass® Credit Card

You will pay a fee for authorized user cards on these cards:

- Delta SkyMiles® Reserve American Express Card – $175 for each authorized user card (see rates and fees)

- Delta SkyMiles® Reserve Business American Express Card – $175 per authorized user (see rates and fees)

- The Platinum Card(R) from American Express – $195 for up to 3 authorized user cards (see rates and fees)

- The Business Platinum Card® from American Express – $300 for each authorized user card (see rates and fees)

Authorized users of American Express cards are issued a separate credit card number. Different card numbers mean you can get more AMEX Offers.

If you aren’t comfortable allowing your child access to your entire credit limit on your American Express card, you can set a limit for each billable period.

For example, you can let your child charge $500 in December because of the holidays. Then in January, you can change the limit to $100.

This prevents your child from going hog wild and running amok with your credit cards.

American Express sends authorized user cards in 2 to 3 business days via FedEx or UPS.

2. Barclays

Happy Birthday – time for a Barclay credit card. Because there aren’t age restrictions on Barclay authorized user cards.

When this post was first published on December 4, 2014, there was no minimum age to add your child to your Barclays cards.

You could add your infant. Nor was there a fee to add authorized users to any Barclays cards.

And you didn’t have to provide the authorized user’s social security number or date of birth.

However, Barclays will not report the information to the credit bureau, unless you provide your child’s social security number.

But now, an authorized user has to be at least 13 years old. And Barclays requires their date of birth and social security number.

Authorized user accounts are reported to the credit bureaus which builds your child’s credit history and credit score.

When you add your child (or another person) as an authorized user to your Barclays cards, you’ll be reminded that you are responsible for all transactions.

Authorized users on Barclay cards can obtain cash advances, request checks, and can request a payment via check for overpaid accounts.

But they can’t close the account or add additional authorized users, request an increase or decrease to your credit limit, or request balance refunds.

A separate credit card number is issued for authorized users of Barclays cards.

Barclay sends authorized users cards via regular mail in 7 to 10 business days. For a fee of $29, you can request to receive cards in 1 to 2 days via FedEx.

3. Chase

“I have a Chase credit card? And you haven’t given it to me?”

You can add anyone as an authorized user on your Chase cards for free. There is no minimum age requirement.

When this post was first written Chase didn’t require a date of birth or social security number to add an authorized user.

Now, Chase requires the authorized user’s date of birth. Chase reports authorized user accounts to the credit bureaus.

Pro-tip: Being an authorized user on Chase cards counts towards the 5/24 limit (5 cards received in 24 months).

Chase also gives you the option to add your child as an authorized user without sending a card.

You will be reminded by Chase that you are liable for the full balance and your authorized users on Chase cards have access to your full credit limit.

Authorized user cards on Chase accounts are sent in 1 to 2 business days via UPS.

4. Citibank

Happy his Citibank authorized user card arrived before vacation

Citibank has no age restrictions for authorized users. They do not require a date of birth, social security number, or fee when you add authorized users to your Citibank cards.

Authorized user accounts on Citibank cards are reported to the credit bureau.

You can have authorized user cards sent express delivery via FedEx for free. Or you can wait 5 to 10 business days for delivery via the postal service.

5. US Bank

“What’s up with the 5 to 10 day waiting period on US Bank authorized user cards?”

There is no minimum age requirement or fee to add an authorized user to your US Bank cards. You have to provide their full name, date of birth, and social security number.

US Bank reports authorized user accounts to the credit bureaus.

US Bank authorized user cards are sent in 5 to 10 business days.

Conclusion

You can add a child as an authorized user on your credit cards.

The benefits of adding your child to your cards far outweigh the risks. By adding your kids to your credit cards you help them establish credit and learn how to budget.

You get the benefits of meeting your minimum spending faster plus bonus points for adding your child to your credit card.

It took about 30 minutes to add my kids as authorized users on all my credit cards. Depending on how many open credit cards you have, it might take less time.

What’s stopping you from adding your kids as authorized users to your credit cards?

Comment, tweet, or share this post.

Get the best credit card signup bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

The information for the Amex EveryDay® Preferred Credit Card has been collected independently by Traveling Well For Less. The card details on this page have not been reviewed or provided by the card issuer.

For Delta Reserve rates and fees, click here.

For Delta Reserve Business rates and fees, click here.

For Amex Platinum rates and fees, click here.

For Amex Business Platinum rates and fees, click here.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Marysa

Friday 1st of April 2022

We have talked about doing this, and it is good to know more about how it all works. I have a teen and I can see some situations where this would be useful.

Catalina

Friday 1st of April 2022

I am so agree that there are different situations when a kid need a credit card. I love the idea that adding them as a authorized user starts their credit history.

Ave

Thursday 31st of March 2022

I had no idea that adding authorized users to your credit cards might earn you perks. My daughter is too young to use a card, but we do teach her how to deal with cash.

Nbam Ana

Thursday 31st of March 2022

Great info! My sister has just added her son as an authorized user to her credit cards. I believe that would definitely help kids learn how to handle finance responsibly.

Jenn

Thursday 31st of March 2022

These are great insights on what to consider about this important step. Making sure the child is responsible and ready for this is key.