American Express Prepaid Cards – Part Two: this is third post in the American Express Prepaid cards series. This post covers adding funds, fees, and how to maximize your miles and points earning ability using the American Express Prepaid Card.

Use the links below to read the entire series on American Express Prepaid Cards. (Links will be active after all posts are published.)

Part 1 of this series – Comparing American Express Prepaid Cards.

Part 2 of this series – the American Express Prepaid Card – Part One

Part 3 of this series – the American Express Prepaid Card – Part Two

Part 4 of this series – the American Express Bluebird Card

Part 5 of this series – the American Express for Target Card

Adding Funds to the American Express Prepaid Card:

You can load funds through a variety of methods:

1) Bank Deposit

You can transfer money from your bank account to fund your card. Simply log into your account and process the transfer or schedule in advance. Funds will be available within 5 business days.

2) Moneypak via Cash

Purchase a Moneypak from participating retailers for $20 – $500, plus a $4.95 fee. Transfer funds from the MoneyPak to your card. Funds will be available immediately.

3) Direct Deposit

Complete the Direct Deposit form and submit to your employer. Deposit all or part of your paycheck. A maximum of $5,000 a month is permitted.

The following Direct Deposits from the U.S. Government are not permitted:

- payroll check if you work for the U.S. Government

- Social Security

- SSI

- civil service retirement

- VA compensation/pension

- worker’s compensation

- Federal Tax refunds

4) Vanilla Reload

Purchase a Vanilla Reload from a Reload Location for $20 – $500, plus a $3.95 fee. Transfer funds from your Vanilla Reload to your card. Funds will be available immediately.

Maximize your miles and points buying Vanilla Reloads:

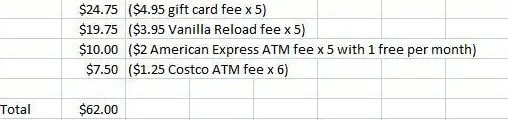

1) Purchase a gift cards from Office Depot using your Chase Ink (Bold, Classic, or Plus) card and earn 5x Ultimate Rewards Points when making purchases at office supply stores.

A gift card loaded with $500 will yield 2,524 Ultimate Rewards Points ($500+4.95 x 5).

Note: Readers and other bloggers are reporting that Office Depot is removing the variable ($20 – $500) gift cards from stores. However, I have not yet found this to be the case in my area.

Use the gift card to purchase Vanilla Reload/s.

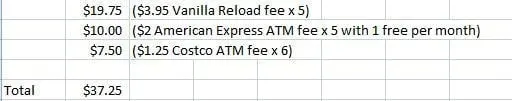

2) Purchase Vanilla Reload/s from CVS or Walgreens using your American Express Hilton HHonors card and earn 6x Hilton HHonors Points when making purchases at drugstores.

A Vanilla Reload card loaded with $500 will yield 3,023 Hilton HHonors Points ($500+3.95 x 6).

Note: The 6x Hilton HHonors Points are only valid for American Express Hilton HHonors cards issued before January 16, 2013. It’s also been reported that the drugstore benefit will be eliminated in May 2013.

3) Purchase Vanilla Reload/s from CVS or Walgreens using your Chase Freedom card and earn 5% cash back (or 5x Ultimate Rewards Points) for drugstore purchases from January 1 – March 31, 2013.

Thanks to reader Chris – note to self: writing posts at 0′ dark thirty is not a good idea least you forget crucial things like the Chase Freedom card…

4) Purchase Vanilla Reload/s from any participating retailer using a miles and points credit card to meet minimum spending requirements.

Maximum Load Amounts:

You can load up to $1,000 per day and up to $2,500 in a 28-day period via Moneypak or Vanilla Reload.

The monthly maximum deposit when funding via Moneypak or Vanilla Reload is $2,500.

You can load up to $5,000 a month when funding via Direct Deposit.

Fees For Using the American Express Prepaid Card:

There are no fees to use the American Express Prepaid card except for ATM fees.

The first ATM withdraw each month is free. Each subsequent withdraw is $2 (ATM operator may charge a fee).

A maximum of $400 can be withdrawn per day.

Getting the Most Miles and Points By Using the American Express Prepaid Card:

Note: Repeated loads and ATM withdrawals could get your card taken away so you may want to mix in a bit of regular spend.

Note: Links to prepaid and credit cards are provided as a courtesy. No financial compensation is received.

Did you like this post? Don’t want to miss any posts? You can Follow me on Twitter or Like me on Facebook. Simply sign up via the subscription links below. If you’d rather receive post updates by email, please use the box below.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Chris

Monday 4th of February 2013

Hi--I live in Mission Valley in San Diego (I've met you at a few events). My OD completely pulled all the gift cards on Saturday. Also, I think your math on the Hilton points is a little bit off--I calculate 0.2 cents/point ($.002). It would be an awful deal to get Hilton points at two cents each.

It's also worth mentioning that the Chase Freedom pays 5x on drug store purchases this quarter (up to $1500 in purchases). Buying Vanilla reloads at CVS with the Freedom card is a great way to get 5x!

Traveling Well For Less

Tuesday 5th of February 2013

Hey Chris,

Yep, I remember you. :)

That's a bummer that the OD near you pulled early. The ODs I checked still have plenty in stock on Sunday evening and no mention of the pull. I'm going to recheck tomorrow.

Thanks, I corrected the math on the Hilton points.

I also added the Chase Freedom benefit.

See you in April? :)

American Express Prepaid - Traveling Well For Less | Traveling Well For Less

Monday 4th of February 2013

[...] series – the American Express Prepaid Card – Part One Part 3 of this series – the American Express Prepaid Card – Part Two Part 4 of this series – the American Express Bluebird Card Part 5 of this series - the [...]