Prepaid cards are becoming more popular. But the world of prepaid cards can be daunting especially when you’re comparing American Express Prepaid Cards.

How do you choose? Which one is better for you?

Miles and points junkies have been raking in frequent flyer miles and points through credit cards (welcome offers/bonuses and purchases) ever since credit card companies started affiliating with the airlines. Now, the rapidly growing trend among the miles and points community is a focus on prepaid cards.

Why prepaid cards? Once you know all the in’s and out’s, combined with large credit card signup bonuses you can leverage more miles and points. But the trick is knowing which prepaid cards to get.

There are several prepaid cards on the market, in this five part series I’m covering American Express prepaid cards.

Part 1 of this series will cover Comparing American Express Prepaid Cards.

Part 2 of this series will cover the American Express Prepaid Card – Part One

Part 3 of this series will cover the American Express Prepaid Card – Part Two

Part 4 of this series will cover the American Express Bluebird Card

Part 5 of this series will cover the American Express for Target Card

If you’re already playing the prepaid card game you’re probably thinking, “Yeah, but what are you going to tell me that I don’t already know or hasn’t already been talked about by every other miles and points blogger, especially FrequentMiler and MillionMileSecrets?

Probably not much, maybe a little gem here or there, but then you, the miles and points junkie whose already using prepaid cards, is not for whom I’ve written this post. So sit back, relax and just enjoy the post/s. And feel free to comment as I’m totally ok with comments, good or bad. Naturally, I prefer good…

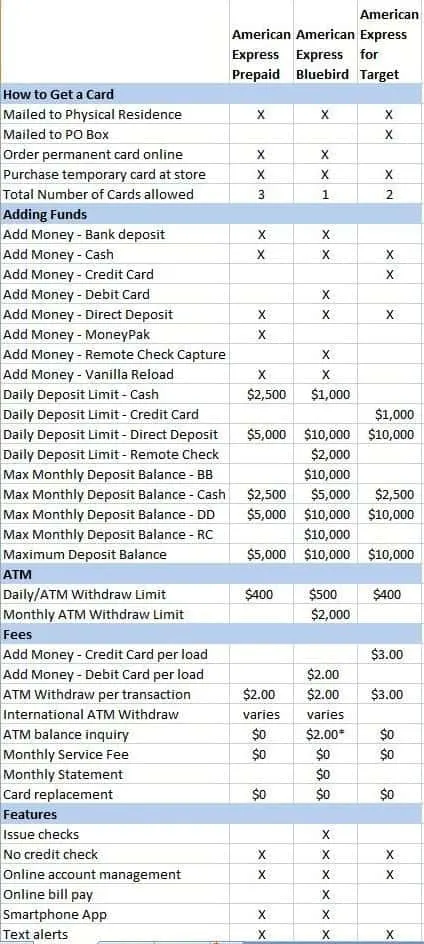

American Express offers three Prepaid Cards: American Express Prepaid, American Express Bluebird, and the American Express for Target Card.

While each offers the same purchase protections as afforded by an American Express credit card, there are subtle nuances to each card as you can see from the chart below.

In Part 2 I’ll discuss the American Express Prepaid card and go into depth about each of the features and fees. I’ll also provide examples on the best way to leverage usage out of the card.

Did you like this post? Don’t want to miss any posts? You can Follow me on Twitter or Like me on Facebook. Simply sign up via the subscription links below. If you’d rather receive post updates by email, please use the box below.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Is American Express Prepaid Card Good? | Credit Owl

Monday 7th of July 2014

[…] […]

American Express Prepaid - Traveling Well For Less | Traveling Well For Less

Monday 4th of February 2013

[...] 1 of this series - Comparing American Express Prepaid Cards. Part 2 of this series – the American Express Prepaid Card – Part One Part 3 of this [...]

American Express Prepaid Card - Part Two - Traveling Well For Less | Traveling Well For Less

Monday 4th of February 2013

[...] 1 of this series - Comparing American Express Prepaid Cards. Part 2 of this series – the American Express Prepaid Card – Part One Part 3 of this [...]

Ariel

Thursday 31st of January 2013

Great post!

Are you still planning on doing the comparison?

I just received an AMEX Prepaid, and have been looking forward to the follow-up articles.

Traveling Well For Less

Thursday 31st of January 2013

Hi Ariel,

Yep, I sure am. Work got the best of my this week so it's a little delayed. It should be up sometime this weekend, Monday at the latest.

Thanks for reading. :)

Scott

Thursday 24th of January 2013

Nice post! Could you add the Wells Fargo PPC on to the spreadsheet as well?

Traveling Well For Less

Thursday 24th of January 2013

Hi Scott,

Thanks. I'm going to post a separate series on the other prepaid cards. I'll be sure to include Wells Fargo PPC on that spreadsheet when I compare it to the other Visa prepaid cards.