You can get a free FICO if you have a Barclays credit card.

Just sign into your account to get your TransUnion FICO score for free.

Yep, there’s no cost. You don’t have to pay anything. No dinero required!

Barclays is offering access to your FICO score for Barclays Arrival card (both the annual fee version and no annual fee version) along with several of their other cards.

Since I don’t have the Arrivals card, I thought I was out of luck. Until I saw this thread on Flyertalk.

If you have the Barclays US Airways card or the Lufthansa card, you can still get your FICO score for free by using a little workaround…

3 Easy Steps To Get Your Free FICO Score

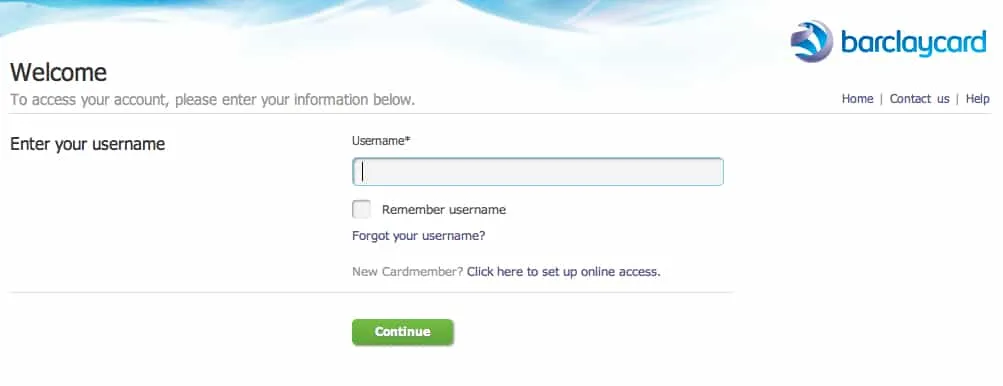

1. Sign into your Barclays account using this url – https://www.barclaycardus.com/servicing/score.

(The only difference between this url and the normal one you’d use is the “/score” at the end.

If you “forget” to use the special url, after you’ve logged into your account the “real” way, just remove everything after “/servicing” and replace with “/score.”

How safe is this url you ask? I have no idea but I used a different computer to log in just in case. Because I’m paranoid like that.

Log into your Barclays card account

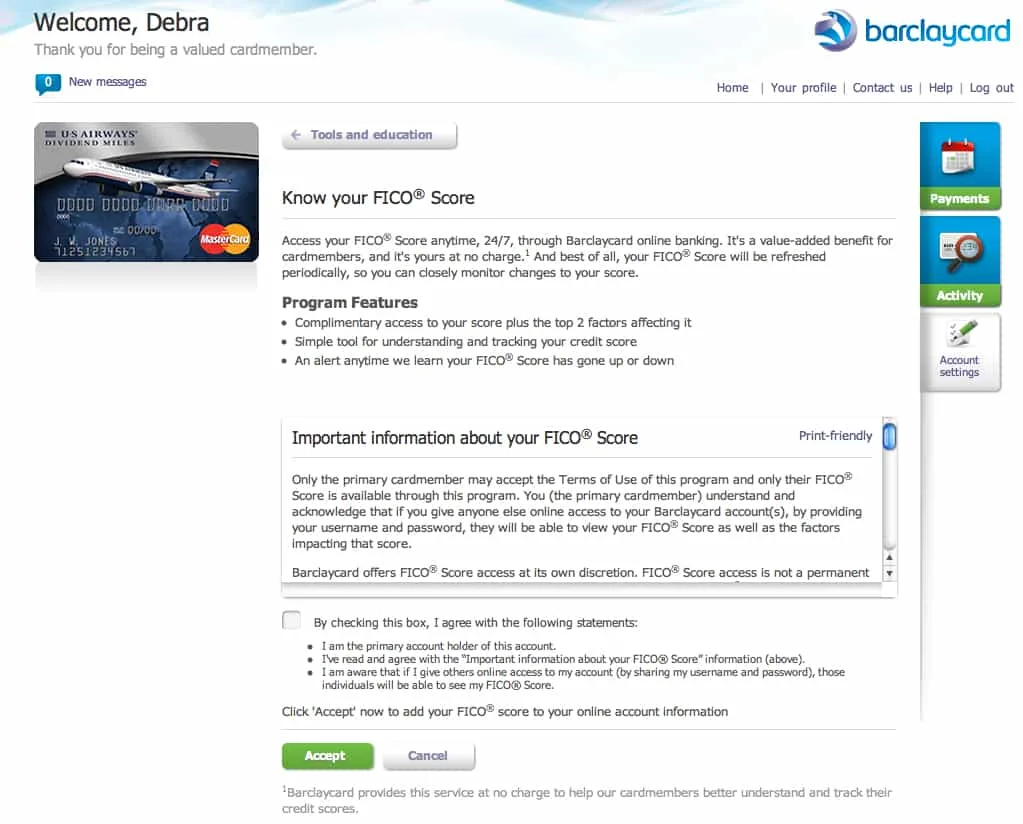

2. Waive your rights and sign away your first born.

Or simply agree to the terms by checking the box and accepting.

Accept the terms

3. Viola, your free FICO score will be revealed.

Your free FICO Score

Have you gotten your free FICO Score yet?

Disclosure: At the time this post was written, I did not earn a commission on these cards.

Want to get more travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Sign up via the subscription links below. To receive post updates by email, please use the box below.

You can also follow me on Twitter or like me on Facebook.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Will

Monday 18th of November 2013

Walmart also offers a free FICO score to their customers. This is under the new open FICO program that FICO has recently announced. I'd expect a lot more credit card companies will follow suit soon.

Traveling Well For Less

Monday 18th of November 2013

Hi Will,

Good to know! It will be nice to see this added to all credit cards.

I just saw a Discover It card ad that mentioned you can get your free FICO score.

Traveling Well For Less

Thursday 7th of November 2013

Hi Fishing4Deals,

You're welcome. :)

In terms of those two factors, sounds like you have a bunch of a new cards and at the time the report was pulled, you had balances.

You can raise your score by not applying for as many cards in such a short period and not using as many cards so that less show balances.

Fishing4Deals

Thursday 7th of November 2013

Thanks for sharing the link to this service. The most interesting aspect, in addition to the numerical score, is the identification of the most important factors impacting your particular credit score.

The two factors cited for me were:

1) Time since most recent account opening is too short; and

2) Too many accounts with balances

Sound advice?