Looking for a quick fee-free way to meet credit card minimum spending? Or just want to earn miles, points, or cash back?

You can process $1,000 without fees through Amazon Register until August 31, 2015.

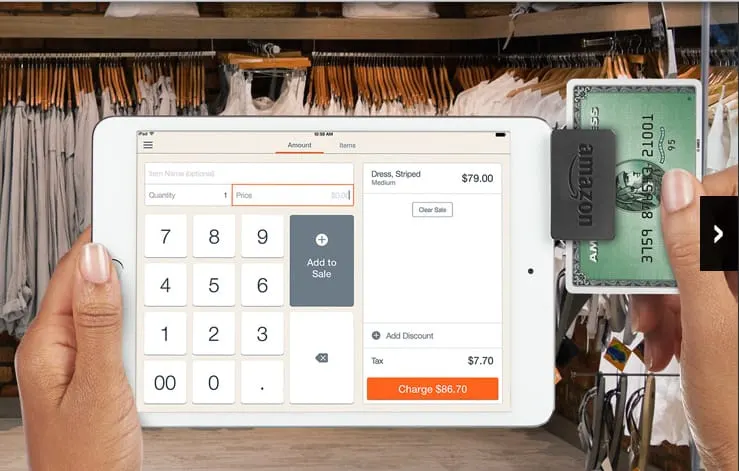

Amazon Register

You can accept credit card payments with Amazon Register which works like Square and PayPal but has lower fees.

Meet $1,000 in minimum spending with $0 fees with Amazon Register

Amazon Register charges a flat rate 2.5% fee per swipe (similar to Plastiq) for credit card transactions such as Visa, Mastercard, Discover, and American Express.

But you get a $25 processing credit when you process your first transaction by August 31, 2015.

So you could run a $1,000 charge with no fees.

This works out great if you have to make minimum spending on a new credit card.

Setting up an Amazon Register Account

You can set up an Amazon Register account as an individual, sole proprietor, partnership, LLC, or corporation.

Keep in mind that Amazon will issue a 1099-K if you have more than 200 transactions in a calendar year AND $20,000 in gross payments processed.

So running $1,000 once should keep you from being sent a 1099.

You have to order an Amazon Register card reader for $10 (affiliate link). And you get free 2-day shipping if you have Amazon Prime (affiliate link).

So in reality, it’ll cost you $10 to process $1,000. But you can do it from the comfort of your home, with no gift card fees, without a Bluebird or REDcard, and you don’t have to deal with WalMart or Target.

When Can You Get Your Money?

Your money is available the next business day on swiped transactions of up to $1,000, if you have automatic daily transfers enabled or transfer the money from your Amazon Payments account to your bank by 4 p.m.

If you have to type in the credit card number, then you might have to wait an extra business day.

Summary of the Fine Print

- Offer is for new Amazon Register customers

- A $25 credit in processing fees applies to your first transaction and must be completed by August 31, 2015

- One $25 credit offer per Amazon Payments account

- Only Amazon Register customers with a US billing address can receive the offer

Conclusion

You can meet $1,000 in minimum spending with no fees when you use Amazon Register by August 31, 2015.

Amazon Register lets you take Visa, Mastercard, American Express, and Discover card payments using your smartphone or tablet.

You’ll pay a flat rate fee of 2.5% per swipe. But you can get a $25 credit when you run your first card payment by August 31, 2015.

Anyone can set up an Amazon Register account. And you won’t be issued a 1099 unless you process more than 200 transactions AND $20,000 in gross payments in a year.

Have you ordered your Amazon Register card reader yet? What’s been your experience with Amazon Register?

Thanks to Russ for sharing LazyTraveler’s post with me.

Did you like this post? Feel free to comment below, share this post, or give me a +1.

Want to get more travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? To receive post updates by email, please use the subscription box below.

You can also follow me on Twitter, like me on Facebook, or add me on Google+.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.