Update: The credit card offer in this post is no longer available. Check our credit card page for the latest offers.

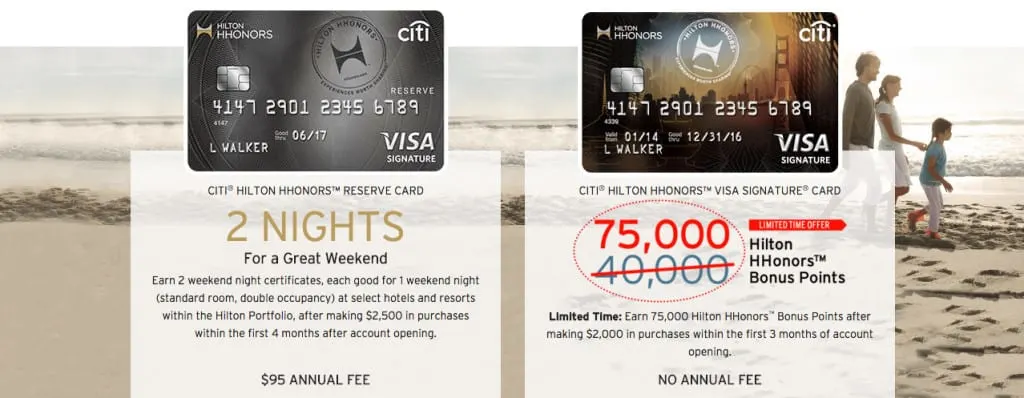

You can earn 75,000 Hilton points after spending $2,000 in purchases with the Citi Hilton Visa Signature card in the first three months of opening your account. But you have to apply by March 31, 2016.

75,000 Hilton points gets you a free night at the Grand Wailea

Normally the bonus is 40,000 Hilton points so this is almost twice the standard sign-up bonus.

Citi Hilton Visa Signature Card

75,000 Hilton point sign-up bonus ends on March 31, 2016

The sign-up bonus on the Citi Hilton Visa Signature card has increased to 75,000 Hilton points. This is the highest offer ever for this card.

With the Citi Hilton Visa Signature card you get:

- Hilton Silver elite status (free internet and late checkout)

- 6 Hilton points for every $1 spent at Hilton hotels

- 3 Hilton points for every $1 spent at US restaurants, US supermarkets, and US gas stations

- 2 Hilton points for every $1 spent on all other purchases

- 10,000 Hilton points when you spend $1,000 at Hilton hotels each year

You can fast track to Hilton Gold elite status (free breakfast, free internet, free upgrades, late checkout, 2 bottles of water) when you stay four times in the first 90 days of opening your account or after spending $20,000 in purchases each year.

This card has NO annual fee.

What Does 75,000 Hilton Points Get You?

How does a free weekend getaway sound? You can stay two nights at DoubleTree by Hilton Hotel Cariari San Jose Costa Rica for 60,000 points and have 15,000 points to use for another trip. And if you use your Southwest Companion Pass the flights are free…except for airport taxes.

Which Citi Hilton Credit Card?

Citi has two credit cards that earn Hilton points, which one is right for you?

You earn 2 free weekend nights at almost any Hilton hotel worldwide after spending $2,500 on purchases in the first four months of opening your Citi Hilton HHonors Reserve card.

The card also offers:

- Free weekend night certificate after spending $10,000 in a calendar year

- 10 Hilton points per $1 spent at Hilton hotels

- 5 Hilton points per $1 spent on airline tickets and car rentals

- 3 Hilton points per $1 spent everywhere else

- No foreign transaction fees

And with both cards you can get the sign-up bonus multiple times (up to seven times).

If you want to stay in the most expensive Hilton hotels and only travel on the weekends, the Citi Hilton Hhonors Reserve would your best choice.

But if you want more flexibility, want to stay at a Hilton during the week, and want to get more value then pick the Citi Hilton Visa Signature card.

Conclusion

You can earn 75,000 Hilton points from the Citi Hilton Visa Signature card when you spend $2,000 on purchases in the first three months of opening your account. But you have to apply by March 31, 2016.

This is the highest sign-up bonus offered on this card.

If you want to get more value from your points and travel during the week, this is a good card for you. But if you want to stay at expensive Hilton hotels on the weekend you should get the Citi Hilton HHonors Reserve card.

Did you like this post? Feel free to comment, share this post, tweet, or give me a +1.

Want to get more travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points?

Use the subscription box below to sign-up and get post updates by email.

You can also follow me on Twitter, like me on Facebook, check out our photos on Instagram, or add me on Google+.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.