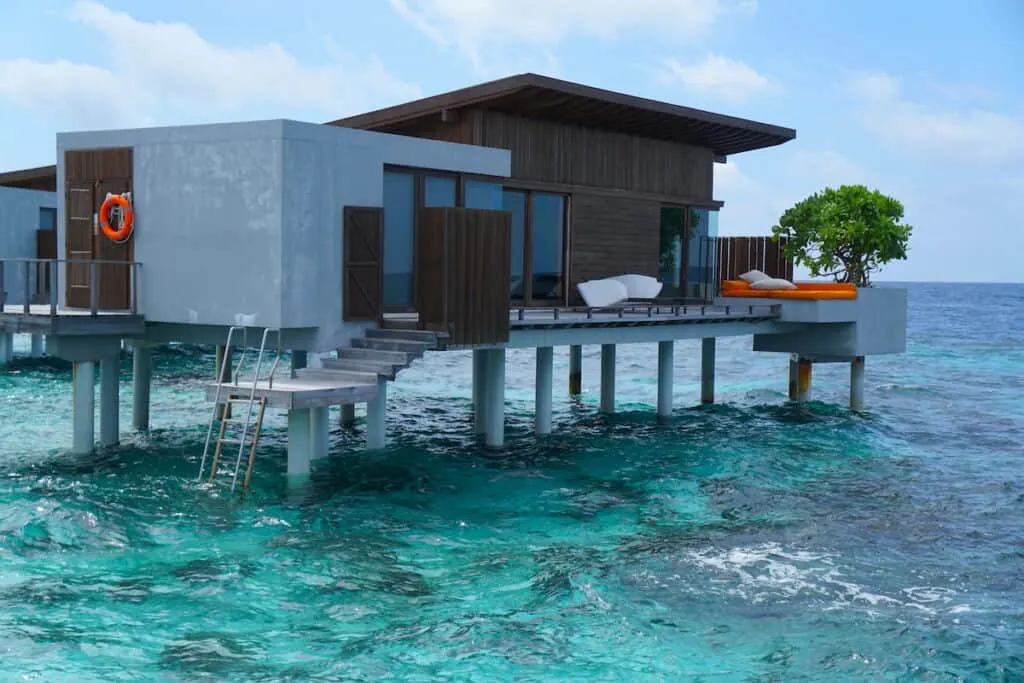

Do you want to travel for free using travel rewards cards? You can get more value from your miles and points with cards that earn flexible transferrable currency such as Chase Ultimate Rewards® points.

You can use Chase Ultimate Rewards points for Hawaii, First Class flights on Lufthansa to Europe, visit Australia, and so many other places.

When you get cards that allow you to transfer your points you can unlock more possibilities. By combining one of these cards with an airline travel rewards card, you can travel the world for free.

The only way to earn Chase Ultimate Rewards® points is by having a card that earns Ultimate Rewards points. You can earn points shopping online but to access the portal, you need a card that earns Chase Ultimate Rewards points.

Whether you’re looking for a personal card or a business card, you can find one that fits your needs. These are all the cards that earn Chase Ultimate Rewards® Points.

Chase Sapphire Preferred® Card

Welcome bonus: You can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months of opening your Chase Sapphire Preferred® Card.

This equals $750 towards travel when you book through the Chase Ultimate Rewards portal.

Why you should get this card: This is a great card if you’re just getting started earning miles and points. With the Sapphire Preferred, you earn:

- 5 points per $1 spent on all travel purchased through Chase Ultimate Rewards®

- 3 points per $1 spent on dining (including dining out, take out, and eligible delivery services)

- 3 points per $1 spent on select streaming services

- 3 points per $1 spent on online grocery purchases (except Target, Walmart and wholesale clubs)

- 2 points per $1 spent on all other travel

- 1 point per $1 spent on other eligible purchases

You can bring this card with you when traveling internationally because there are no foreign transaction fees. This card includes travel insurance benefits such as Trip Cancellation/Interruption Insurance, Lost Luggage Insurance, and more.

A nice thing about the Sapphire Preferred is the annual fee is only $95.

Learn more and how to apply for the Chase Sapphire Preferred® Card.

Chase Sapphire Reserve®Card

Welcome bonus: You can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months of opening your Chase Sapphire Reserve® Card.

This equals $900 toward travel when redeemed through the Chase Ultimate Rewards portal.

Why you should get this card: This is one of the best travel rewards cards. With the Sapphire Reserve, you earn:

- $300 yearly travel credit every card anniversary year

- 10 points per $1 spent on hotel and car rental purchases through the Chase Ultimate Rewards portal (after the $300 travel credit)

- 5 points per $1 spent on airfare booked through the Chase travel portal

- 3 points per $1 spent on travel

- 3 points per $1 spent on dining

- 1 point per $1 spent on all other eligible purchases

You can relax in comfort when flying because this card gives you up to $100 credit every four years for Global Entry, TSA PreCheck, or NEXUS and free access to over 1,300 airport lounges and entrance to the Sapphire Lounges.

Like the Chase Sapphire Preferred, the Chase Sapphire Reserve has no foreign transaction fees and offers Trip Cancellation/Interruption Insurance, Lost Luggage Insurance, and more.

The yearly $300 travel credit and access to airport lounges easily covers this card’s annual fee of $550.

Learn more and how to apply for the Chase Sapphire Reserve® Card.

Chase Freedom Unlimited®

Welcome bonus: You can earn an additional 1.5% cash back on all your purchases up to $20,000 in your first year with the Chase Freedom Unlimited®. No receipts or forms to fill out. Chase will automatically give you an extra 1.5% on the cash back you earn.

There is no limit to how much cash back you can earn! For the extra bonus, every $1 you spend is matched dollar for dollar up to $20,000.

Why you should get this card: This card makes our list of the 10 best balance transfer cards with 0% intro APR. With the Freedom Unlimited, you earn:

- 5% cash back on travel booked through the Chase Travel Portal

- 3% cash back at drugstores

- 3% cash back at restaurants (including delivery and takeout)

- 1.5% cash back on all other purchases

Technically, a cash back card, but you can use your points for travel when paired with cards like Chase Sapphire Preferred, Chase Sapphire Reserve, and Ink Business Cash.

You’ll want to keep this card because the Freedom Unlimited has no annual fee.

Learn more about and how to apply for the Chase Freedom Unlimited®.

Chase Freedom Flex℠

Welcome bonus: You can earn a $200 Bonus after you spend $500 on purchases in your first 3 months from opening your Chase Freedom Flex℠.

Why you should get this card: This is a good card if you spend a lot at drugstores. With the Freedom Flex, you earn:

- 5% cash back on up to $1,500 on rotating bonus categories every quarter (activation required)

- 5% cash back on travel purchased through the Chase travel portal

- 3% back at restaurants

- 3% back at drugstores

- 1% back on all other purchases

You can use your cash back rewards for travel if you have a card such as the Chase Sapphire Preferred and Ink Business Cash.

This card has no annual fee.

Ink Business Unlimited® Credit Card

Welcome bonus: You can earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months of opening your Ink Business Unlimited® Credit Card. This is worth 75,000 Ultimate Rewards points.

Why you should get this card: This is an easy card because there aren’t any bonus categories to track. You earn unlimited 1.5% cash back on all purchases made for your business.

This is a great card for your business because it has no annual fee.

Learn more and how to apply for the Ink Business Unlimited® Credit Card.

Ink Business Cash® Credit Card

Welcome bonus: You can earn $750 bonus cash back worth 75,000 Ultimate Rewards points after you spend $6,000 on purchases in the first 3 months of opening your Ink Business Cash® Credit Card.

Why you should get this card: This is one of the best cash back cards for small business owners that allows you to earn redeemable points for travel. With the Ink Cash, you earn:

- 5% cash back on the first $25,000 in combined purchases each year spent on office supply store purchases and internet, cable and phone services

- 2% back at gas stations and restaurants on up to $25,000 in combined purchases every year

- 1% back on all other purchases

You can instantly transfer your points to 14 airline and hotel partners.

This card has no annual fee.

Learn more and how to apply for the Ink Business Cash® Credit Card.

Ink Business Preferred® Credit Card

Welcome bonus: You can earn 100,000 Chase Ultimate Rewards points after spending $8,000 on purchases in the first three months of opening your Ink Business Preferred® Credit Card.

That’s $1,250 toward travel when redeemed through the Chase Ultimate Rewards travel portal.

Why you should get this card: This is one of the best credit cards for small business owners who want a high bonus, flexible points, and a low annual fee. With the Ink Business Preferred, you earn:

- 3 points per $1 spent on the first $150,000 in combined spending each year on travel, shipping, internet, cable, phone, and ads on social media and search engines

- 1 point per $1 spent on all other purchases

You can bring this card when traveling to other countries because there are no foreign transaction fees.

Save money on airline tickets and hotels by transfering your points to 14 airline and hotel partners.

This card has a $95 annual fee.

Learn more and how to apply for the Ink Business Preferred® Credit Card.

Other Chase Cards

Other Chase cards earn Chase Ultimate Rewards points such as the Ink Business Unlimited® Credit Card, Ink Bold, Ink Plus, and Chase Freedom.

But the points from the Ink Unlimited aren’t transferrable to loyalty program partners. You can only use them for cash back.

The Ink Bold, Ink Plus, and Chase Freedom are closed to new applicants. Holders of these cards still earn Ultimate Rewards points.

Expiration of Chase Ultimate Rewards Points

Chase Ultimate Rewards points do not expire as long as you have a card that earns Ultimate Rewards points.

If you decide to cancel a card that earns Ultimate Rewards, you have to transfer or use your points before closing your card. Or you will lose all your points.

Before canceling a card, consider asking for a retention offer.

Chase Ultimate Rewards Transfer Partners

Transferring Ultimate Rewards gives you the most value for your points and the greatest flexibility.

You can transfer Chase Ultimate Rewards to 14 airline and hotel partners:

- Aer Lingus

- Air Canada

- Air France – KLM

- British Airways

- Emirates

- Iberia

- IHG

- JetBlue

- Marriott

- Singapore Airlines

- Southwest Airlines

- United Airlines

- Virgin Atlantic

- World of Hyatt

Points transfer instantly on a 1:1 ratio, minimum of 1,000 point increments. So 100,000 points become 100,000 miles or hotel points.

Because points don’t expire if you have at least one active Ultimate Rewards earning card, you can keep your points in your Ultimate Rewards account until you’re ready to use them.

Conclusion

Cards that earn transferrable currency like Chase Ultimate Rewards points offer the most flexibility and freedom to travel.

With 14 redemption partners, you can use your points to travel the world for free.

Comment, tweet, or share this post.

Get the best credit card bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Support us on Patreon | Buy Me a Coffee

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Corinne

Tuesday 9th of January 2024

Yes! Chase cards and points are the way to go. Thanks for all of your tips. I'm definitely going to try to use my card more often to collect the points.

Debra Schroeder

Monday 15th of January 2024

Hi Corinne,

So glad you enjoyed the tips. Let me know if you need any help.

Paula

Wednesday 3rd of January 2024

This is terrific information!!! I love that you broke down all the details. Pinning to save this!

Debra Schroeder

Wednesday 3rd of January 2024

Hi Paula,

Glad you enjoyed the post.

Sage Scott

Tuesday 2nd of January 2024

This article couldn't have come at a better time. I'm breaking up with Southwest Airlines (my current Chase card) and looking for better options. Thanks for the tips!

Debra Schroeder

Wednesday 3rd of January 2024

Hi Sage,

Let me know if you need any recommendations to replace your "ex." 😂

Taryn

Wednesday 20th of December 2023

Longtime Chase cardholders and newer to travel hacking...this is so helpful! There's a ton of info out there on individual cards, and comparisons, but something this thorough is like a unicorn. Thank you!

Debra Schroeder

Thursday 28th of December 2023

Hi Taryn,

So glad the post was helpful. Let me know if you have any questions.

jake

Tuesday 19th of December 2023

We were thinking about becoming Chase card members and had no idea about some of these benefits. This article is so helpful! Definitely signing up now after reading this. Thank you

Debra Schroeder

Tuesday 19th of December 2023

Hi Jake,

Chase cards are among the best travel rewards cards. Which particular benefits do you have questions about?