I’ve written about whether buying money orders could get you convicted of money laundering before. Recent events have suggested it’s time for a reminder post. If you’re buying money orders, you may want to read my post on everything you need to know structuring.

As a reminder:

- I am not a lawyer

- I am not a CPA

- I do not work for the federal government

- I do not work for a bank

With that in mind, this is merely from me. Someone who likes rules. Who prefers black and white. And is uncomfortable in the gray area.

You can play big when you play within the rules. Especially if you need structure. (Ironic, I know. But I had to get that pun in there.)

Structuring (Smurfing)

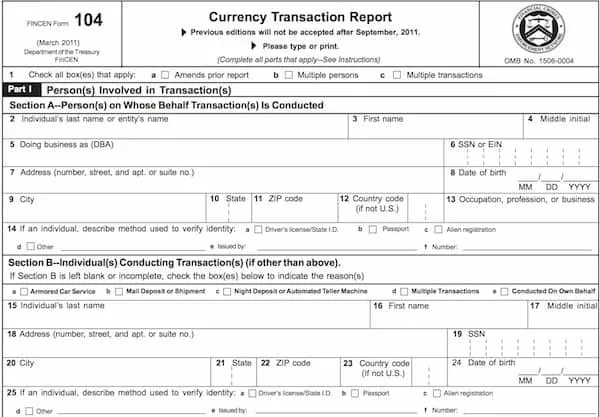

Are you structuring to avoid having a Currency Transaction Report (CTR) filled out?

Structuring or smurfing (not to be confused with the little blue guys and one gal) is when you manipulate your financial transactions so that they are under the reportable amounts.

You can read the lengthy IRS definition of structuring.

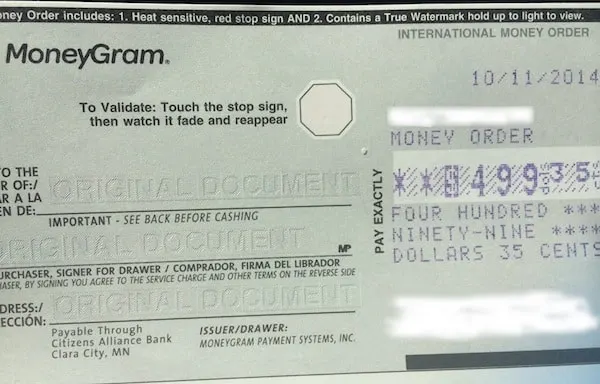

Money Orders

Buying money orders under the reportable amounts could make the government think you’re structuring

This means buying money orders for less $3,000. Not a single money order for less than $3,000. But a total of $3,000 in money orders at one place.

However, some places like big box stores that favor the color blue, the post office, drug stores, and/or grocery stores may have lower reporting limits when buying money orders.

So you might be asked to fill out paperwork if you’re buying $1,000, $1,500, or $2,000 worth of money orders at a time.

Even if the Bank Secrecy Act of 1970 (BSA) has a $3,000 a day limit.

Bank Deposits

If you are depositing $10,000 or more at one time at the same bank, the bank is required to complete a Currency Transaction Report (CTR).

And if they suspect you of making deposits of less than $10,000 to avoid the reporting, a Suspicious Activity Report (SAR) is filed with the US Treasury Department. This is what happened to Eliot Spitzer.

Things to Keep in Mind

1. A Long Process

It takes the federal government a long time to build a case against you.

So just because no one has come to your house, started to ask questions, or shut you down, does NOT mean that you are safe.

Nor does it mean that your behavior and patterns aren’t being observed.

2. Frozen Assets

IRS can seize your funds

Once Treasury officials show up, your assets will be seized. (If you’re a small business, your assets might not get seized.)

3. You’re Guilty Until Proven Innocent

Because this structuring is a civil crime, you have to prove your innocence. If convicted you can be fined and/or sentenced to 5 years in jail.

Buying Money Orders: You Might be Structuring if…

Now that you understand the implications, let’s go into a few examples of what could be construed as structuring.

1. You Buy Money Orders at Multiple Places

If you’re buying money orders under reportable limits at multiple places on the same day you might be structuring.

This means driving around town and visiting multiple stores that sell money orders.

And buying under the limit that requires reporting.

2. Your Friends Help You Buy Money Orders

If you enlist the help of friends and family to buy money orders for you if you could be structuring.

This is also called smurfing.

3. Your Friends or Family Deposit Money Orders for You

You might be structuring (or smurfing) if you ask friends and family to deposit money orders for you.

4. You Buy Money Orders on Multiple Days

Buying money orders on multiple days to avoid being reported could also be considered structuring.

5. You Have Several Bank Accounts To Deposit Your Money Orders

If you have several bank accounts where you deposit your money orders you might be structuring.

Even if you only use these accounts to hold the funds temporarily and then pay off your credit card.

6. You Deposit Less Than $10,000 Into Your Account

You could be structuring if you make deposits of less than $10,000 into your bank account.

Especially if you spread out these amounts over several days.

7. You Deposit Less Than $10,000 Into Multiple Banks

If you make multiple bank deposits at different banks, all under the $10,000 limit, you might be structuring.

Conclusion

If you’re new to buying money orders, read my post on whether buying money orders could get you convicted of money laundering.

So long story short, if you’re going to keep buying money orders, do NOT play games. If you have to fill out paperwork, fill out paperwork.

Deposit more than $10,000. Don’t break up your deposits and go to various banks.

Play by the rules and stay out of jail.

What are your thoughts? Does your behavior give you any pause? Could you be structuring and not know it?

Comment, tweet, or share this post.

Get the best credit card signup bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Nani

Monday 13th of April 2020

Okay. What if I want to deposit $12,500 to my bank account? What happens?

Debra Schroeder

Wednesday 22nd of April 2020

Hi Nani,

The bank will fill out a Currency Transaction Form - you can read about it this post.

Don't worry, it's not a big deal.

SS

Saturday 14th of September 2019

So are you still structuring if you drive around town, but in each location, buy the max and fill out a form? eg stop one $8000 ( max ) SS# required + driver license 2. $3000 max driver license recorded 3. $3000 max driver license recorded total $14000 purchased in 1 day, ID recorded at all locations Bank 1 - deposit $14K in to bank

Debra Schroeder

Saturday 12th of October 2019

Hi SS,

Hard to say, it depends on who is looking at your actions. I wouldn't consider it structuring. But I don't work for the federal government and aren't a lawyer.

Xshanex

Thursday 30th of March 2017

What are the recent events you reference?

Debra Schroeder

Sunday 2nd of April 2017

Hi Xshanex,

I wrote this post last year. Nothing recent to note. :)

thomas burke

Saturday 26th of November 2016

can you get in trouble for buying multiple money orders to pay off your credit card or car payment? since its not deposited into my bank? but into my creditor accounts for payment?

Charles McCool

Friday 29th of January 2016

Smurfing? New term to me. Then again the whole money order "game" is new. I will just bounce around here a bit and learn the rules.

Debra Schroeder

Friday 29th of January 2016

Hi Charles McCool,

Glad I could share something new with you. Let me know if you have any questions.