Finding the cash back, balance transfer, or 0% APR credit card is like finding a needle in a haystack. And when big sign-up credit card offers come around, sometimes it’s like a feeding frenzy. Where you need to jump on the deal before it ends. It makes you feel like you have to be on your computer all day, every day. If only there was a magic credit card finder. You’re in luck because there is, CardMatch Tool.

Credit Card Finder: CardMatch Tool

Photo credit: Pixabay

So when Kelly emailed and asked:

How can I find travel rewards cards and credit card offers?

Here’s what I told her.

Kelly can use a special credit card finder like CardMatch tool to search for credit card offers.

One of the quickest and easiest ways to search for travel rewards cards offers is to use the CardMatch tool.

The CardMatch tool shows Kelly the best credit card offers. And it’s personalized for each user.

When Kelly enters her information, she’s shown the credit cards selected for her. If her husband enters his information, he’s shown travel rewards cards for him.

The same credit card offers might be shown to Kelly and her husband. But they might not.

So each person gets offers based on their credit score.

Why Use a Credit Card Finder Like CardMatch Tool

With all the travel rewards cards offers out there, why use a credit card finder like the CardMatch tool?

Because with the CardMatch tool, Kelly will save time. And as we all know time is money.

More Likely To Get Approved

Getting denied or the dreaded reconsideration for a credit card is a bummer. But when Kelly uses the CardMatch tool that’s less likely to happen. Because she’s more likely to get approved.

What’s great about using the CardMatch Tool is that Kelly is more likely to qualify for the offers shown. Her chances of getting approved for a credit card are greater when she uses the CardMatch Tool.

When using a credit card finder like the CardMatch tool, it shows lots of cards. So they aren’t considered pre-qualified offers.

A pre-qualified offer is where all Kelly would have to do is submit her information and she’d get the card. Kelly still has to apply for the credit card she’s interested in.

The credit card offers shown to Kelly using a credit card finder will be ones she’s more likely to get approved for.

No more applying and get denied. Kelly can apply for the credit cards she has a greater chance of getting approved for.

Targeted Offers

Find targeted offers using a credit card finder like CardMatch tool.

Photo credit: Pixabay

Targeted offers are some of the highest credit card signup bonuses. Travel rewards cards sign-up bonuses of 100,000 points are usually targeted offers.

Those offers are rarely available to everyone. The few times they are public offers, you have to quick. Because they could expire within days, sometimes hours.

By using a credit card finder, Kelly can search for her targeted offers online. Instead of waiting by her mailbox hoping to get one in the mail

Kelly can use the CardMatch tool to check for her targeted offers.

Read this post to find out if you can use someone else’s Amex Platinum RSVP Code for 100,000 points.

Doesn’t Affect Credit Score

A credit pull is not done when using the CardMatch tool. It’s a soft inquiry that does not appear on Kelly’s credit report.

So Kelly’s credit score is not affected when she uses the credit card finder. And she can use the CardMatch tool as often as she likes. Checking

Because the offers can change, she can check every day or every week to find her best-targeted offers. And her credit score won’t take a hit.

Kelly’s credit score won’t be affected.

Kelly’s credit score will change if she applies for a credit card. A hard inquiry occurs when Kelly applies for a credit card or takes out a loan.

A hard inquiry has a temporary effect on Kelly’s credit. Usually a matter of 50 points or so. However, the effect on each person’s credit score may vary.

And if Kelly’s approved for a new card, her score may increase. Because now her debt to credit ratio has improved.

Which Banks Have Offers on CardMatch

Kelly may be wondering if the CardMatch tool only offers certain credit cards offers. She shouldn’t worry because all the big banks are part of CardMatch:

- American Express

- Capital One

- Chase

- and more

So Kelly can find some of the most popular travel rewards cards. Assuming she’s targeted for those offers.

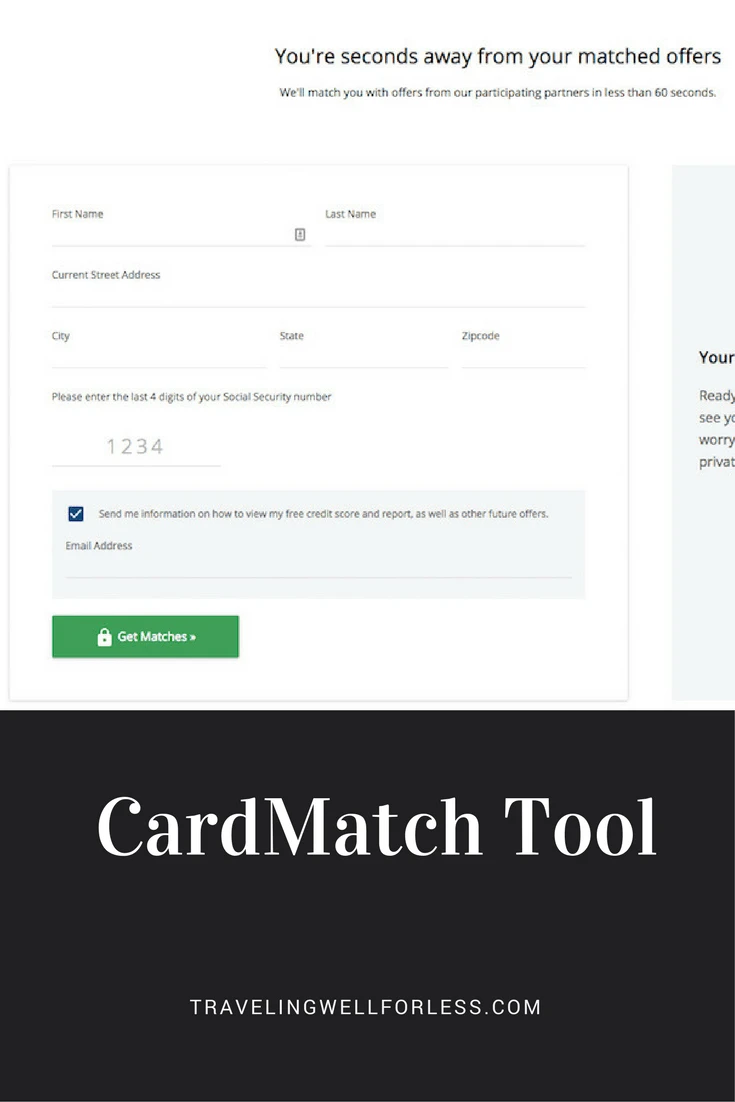

How to Use a Credit Card Finder, CardMatch Tool

Here’s how to use a credit card finder like the CardMatch tool.

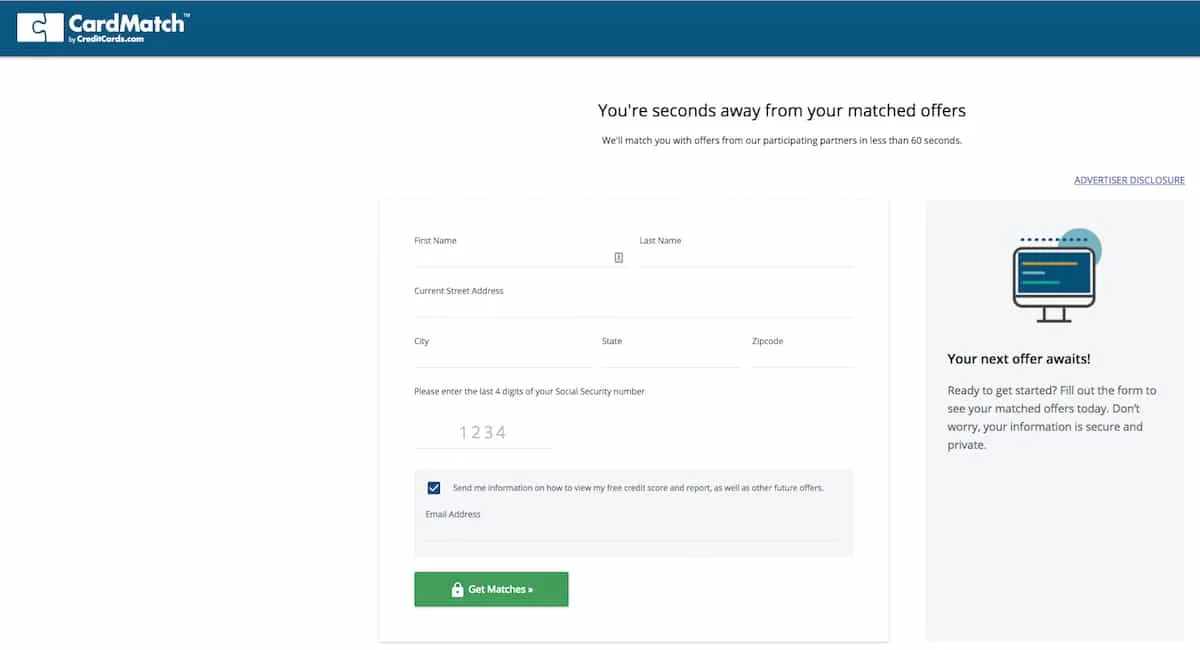

1. Go to the CardMatch Tool website

Credit card finder: CardMatch tool

Kelly will enter her information: full name, address, and last 4-digits of her Social Security number. Then click the green box, “Get Matches.”

If Kelly wants a free credit report and score, she’ll keep the box checked and enter her email address. She’ll have to confirm her email address before receiving her credit report.

Or she can do like I did, and uncheck the box.

Pro-tip: Kelly can get your credit score for free from several credit cards. No need to signup for another service.

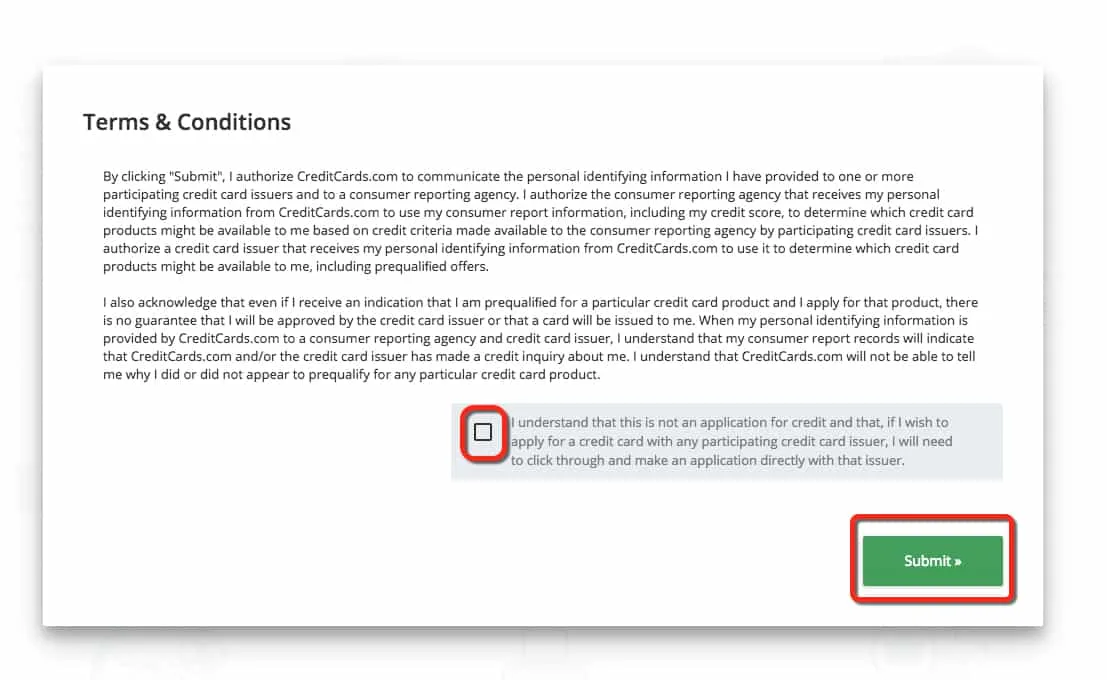

2. Accept the terms and conditions.

CardMatch tool terms and conditions

A popup box will appear with the terms and conditions. Kelly has to accept these before she can get her credit card offers.

She will check the box and then click the green “Submit” button.

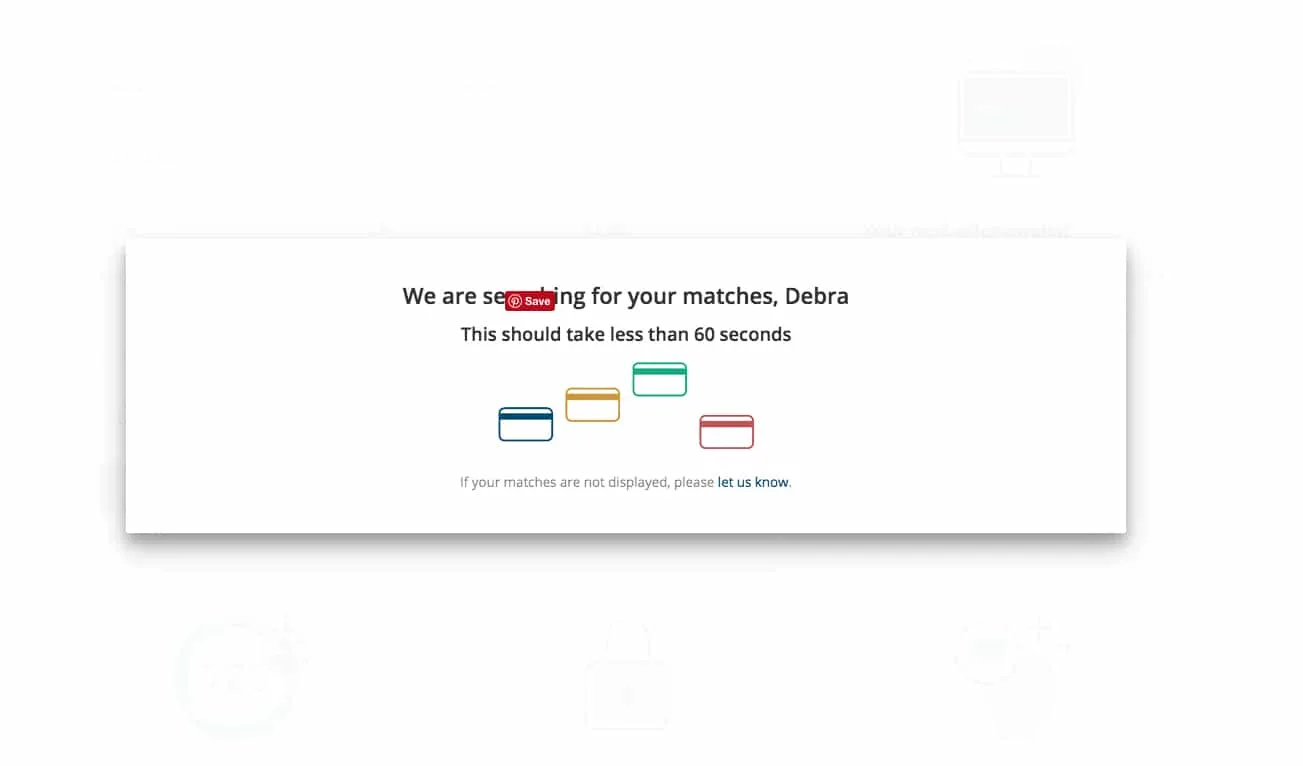

It takes less than 60 seconds

Kelly will see another popup box telling her that they are searching for her matches. This takes 60 seconds or less.

I entered my information and it took about 5 seconds to pull up my matches using the credit card finder.

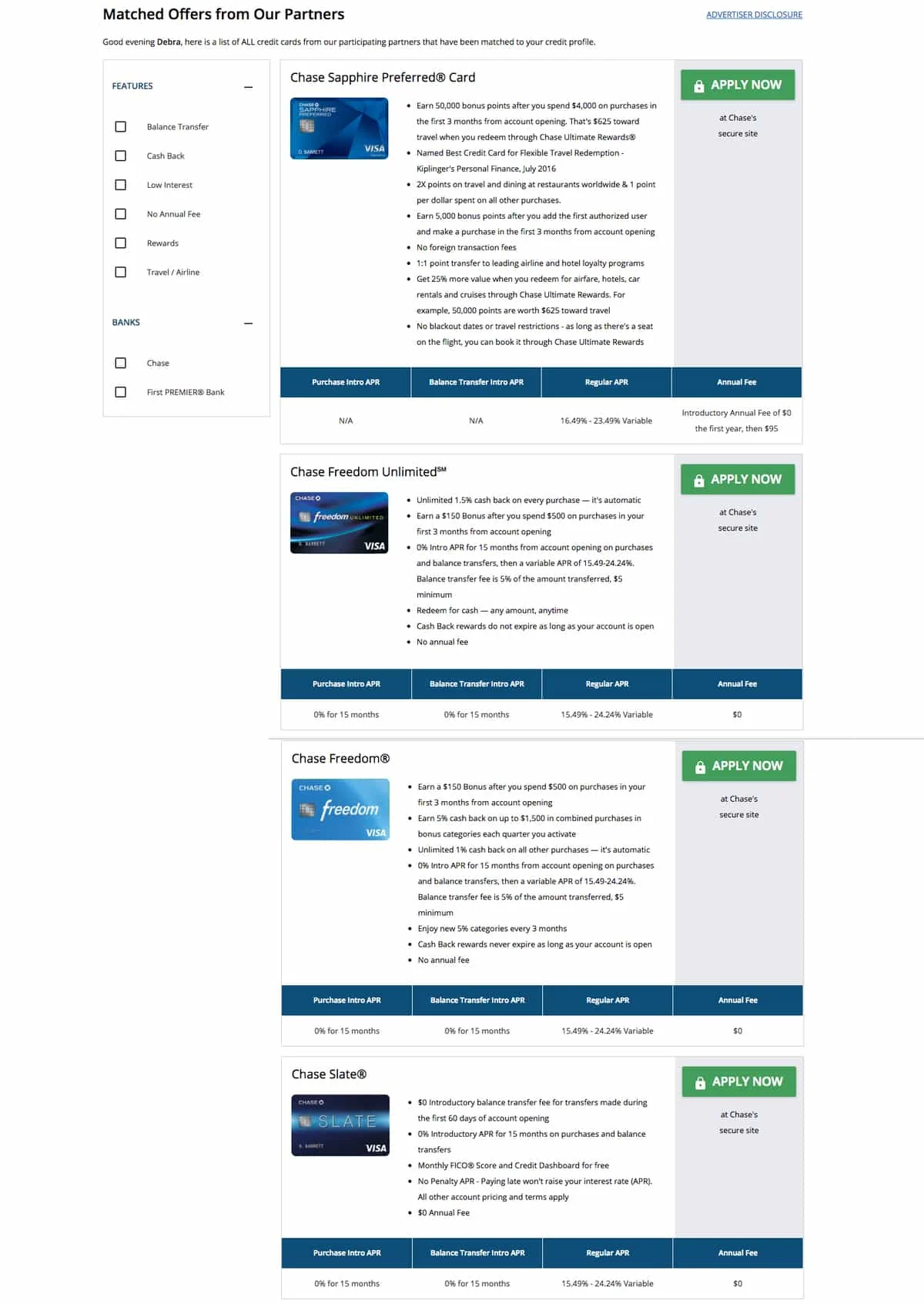

3. View Your Credit Card Offers.

Which offers did you get?

In less than 60 seconds Kelly gets a list of targeted offers for travel rewards cards.

4. Apply for Credit Cards.

Apply for new credit cards.

Photo credit: Pixabay

Kelly can apply for the offers she finds using the CardMatch tool. She can use the big green “APPLY NOW” button.

Kelly will get better offers with high sign-up bonuses if she has good credit. Usually, if she already has cards from one bank, she may not get any targeted offers from them.

But this wasn’t the case for me. Despite having 9 Chase cards, I still got targeted offers for four different Chase cards.

Conclusion

Kelly is looking for a new travel rewards card or other credit cards. She can use a credit card finder like the CardMatch tool.

The CardMatch tool is quick and easy to use. Kelly will get offers that she’s more likely to get approved for.

Especially targeted offers that aren’t available to the public. And using it won’t cause a hard inquiry on Kelly’s credit report.

Because the credit cards in the CardMatch tool can change, Kelly can search for new offers as often as she likes.

But she shouldn’t wait to apply. Because the best travel rewards cards and credit card offers can disappear.

Have you used a credit card finder like the CardMatch tool? If so, what credit cards were you offered?

Blog posts on how you can use travel rewards points:

- How to Travel for Free With Travel Rewards Cards

- Review: Lufthansa 747-8 First Class Los Angeles to Frankfurt for $40

- Our First Class Hawaiian Airlines Honolulu to Sydney Flight for $63

- The How to Luxury Guide to Sydney on $85 a Day

- Two Weeks in Hong Kong & Australia on $93 a Day

Pin this to your travel, vacation, travel tips, or travel hack board:

Comment, tweet, or share this post.

Get the best credit card signup bonuses.

Follow us on Twitter | Facebook | Pinterest | Instagram | YouTube

Got a question? Or want help, suggestions, travel tips, learn how to travel for free, find out about travel deals, and maximize your miles and points? Use the subscription box below to sign-up and get post updates by email.

Traveling Well For Less has partnered with Your Best Credit Cards for our coverage of credit card products. Traveling Well For Less and YBCC may receive a commission from card issuers.

Chubskulit Rose

Friday 17th of March 2017

I love what Discover has to offer this year. This tool is great, you can really find cards that can offer a lot of perks.

Shaney Maharaj

Thursday 16th of March 2017

Wow, this is so cool. I've never heard of something like this before but I wouldn't mind using it.

Gabriel

Thursday 16th of March 2017

We are almost to the point where we've rebuilt our credit enough that we can consider shopping for a card based on the perks, this is a powerful tool to have.

Wildish Jess

Thursday 16th of March 2017

I've been considering getting a new card. I'll have to check this tool out!

Eileen

Wednesday 15th of March 2017

There are so many credit cards out there, it's good that there's a tool like this to find which one is right for you. Definitely a valuable resource when it comes to choosing the right one.